Table of Contents

Budgeting sounds simple in theory. You make a plan for your money, you stick to it, and boom—you’re thriving. But in real life? Budgeting can feel like trying to fold a fitted sheet with one hand while your toddler spills cereal in the background.

If you’ve ever looked at your bank account and thought, “Where the hell did all my money go?”—girl, you are not alone.

I’ve made every budgeting mistake in the book. I paid my bills on time, wasn’t drowning in debt, and I even saved a little here and there. But I still ended up broke and confused, asking myself how I spent $85 on Amazon when I was only searching for shampoo. (Spoiler: my kids didn’t need those extra water bottles. At all.)

The truth is: budgeting mistakes don’t mean you’re bad with money. It just means no one ever taught you how to actually manage your finances in a way that makes sense for your real life.

So let’s fix that. Here are the 10 most common budgeting mistakes (and yes, I’ve made all of them), and how to avoid them so you can finally start making your money work for you.

1. Not Having a Budget at All

Look, I get it. Budgeting can feel overwhelming, especially when money already feels tight. But flying blind with your finances is a one-way ticket to “How did we overdraft again?”

How to fix it:

Start simple. Forget the 48-tab spreadsheet. Try the 50/30/20 rule:

- 50% → needs (rent, groceries, bills)

- 30% → wants (takeout, Target runs, anything fun)

- 20% → savings + debt

Or grab a free budget planner (hey bestie, I got one if you sign up to the newsletter all the way at the bottom of this post. Make it visual, make it yours, and keep it basic. Progress is better perfection.

2. Underestimating Expenses

You ever get hit with your Amazon Prime annual fee and suddenly want to throw your phone? Same.

We all forget random one-time bills, car tags, school (or homeschool!) fees, and that sneaky parking ticket from 3 months ago.

This is what you should do:

Track every single thing you spend for at least 30 days. You’ll start to see patterns—and more importantly, you’ll stop being surprised by “surprise expenses.” Build a buffer into your monthly budget for those “oh crap” moments.

3. Overlooking Small Purchases

“It’s just $9.99” has scammed me out of hundreds of dollars.

It’s not the big purchases that usually wreck your budget—it’s the 87 small ones you forgot even happened.

How to fix it:

Log every swipe. Every cart. Every “It’s just a little treat.” Once you see it totaled at the end of the week, you’ll understand exactly where the money went—and why your bank account is giving broke energy.

4. Setting Unrealistic Goals

“I’m going to spend $50 on fast food this week!” —Me, 1 year ago, before blowing $95 by Wednesday.

Do this: Be honest with yourself. If you know you’re going to order takeout on Fridays, budget for it. A budget that doesn’t include your real life is going to fail faster than that juice cleanse I never finished.

Leave room for real spending. The goal is sustainability, not starvation.

5. Failing to Adjust the Budget

Life changes. Paychecks shift. Kids grow. Inflation inflates.

If your budget stays the same through all of it, it’s not going to work for long.

So, check in monthly. Just like you check your hair in the mirror before leaving the house, check your budget before stepping into a new month. It doesn’t have to be a whole event—just a quick review to see what’s working and what needs adjusting.

6. Not Prioritizing Savings

For a long time, I saved whatever was “left over” at the end of the month. And sometimes, there wasn’t much left.

So, what do you do? Pay yourself first. Even if it’s $20. Move it to a savings account as soon as your paycheck hits. Treat it like a bill. Future you deserves a soft place to land.

Also, savings aren’t just for emergencies. They’re for freedom; vacations, new homes, peace of mind.

7. Ignoring Debt Repayment

Girl, I get it. Debt feels heavy. It’s easier to pretend it’s not there than to stare it in the face. But all it does is weigh you down in the background.

Choose a method that fits your lifestyle:

- Debt snowball → pay off the smallest balance first

- Debt avalanche → pay off the highest interest first

Either way, start somewhere. Even a $50 monthly payment can be a game-changer over time. Learn more about these debt payoff methods here.

8. Lack of Accountability falls under budgeting mistakes

You ever make a budget, feel amazing, then ignore it for two weeks? YUP.

That’s what happens when no one’s holding you accountable but your tired, overstimulated brain.

Find a budgeting buddy. Whether it’s your partner, your group chat, or an online community, having someone to talk money with keeps you focused and motivated.

9. Overcomplicating the Budget

If you’ve ever given up on budgeting because you couldn’t keep up with all the categories, spreadsheets, or color coding… hi, you’re me. I given up YEARS ago when I had to idea what I was doing.

My recommendation? Keep. It. Simple.

You don’t need 37 categories. Stick to your top 5:

- Housing

- Food

- Transportation

- Debt

- Savings

Make it easy to update and check in with—otherwise you won’t.

10. Not Planning for Fun

The fastest way to kill your budget? Not planning for fun.

We’re not out here building a life we hate just to have a perfect budget.

Include joy in the budget. That concert ticket, that Friday takeout, that little trip to the dollar section at Target—you can have it. Just plan for it. Fun is not optional. It’s part of a life you actually want to live.

Final thoughts

Budgeting isn’t about restriction. It’s about freedom.

Freedom from wondering how you’ll pay that bill.

Freedom from money fights.

Freedom to say yes to things that actually matter.

And yes—you’re going to make mistakes. I still do. But now, I catch them faster. I course-correct. And I keep moving forward.

So if you’ve made one (or all) of these budgeting mistakes? It’s okay. Start fresh today. Your next money move can be your best one.

P.S. If you’re ready to take your budgeting game to the next level, check out my favorite budgeting tools down below!. Let’s make 2025 the year we finally crush our financial goals!

Cash Envelope Labels | 56 Categories

Stay on top of your budgeting goals with these Printable Cash Envelope Labels! Designed to fit perfectly in your A6 binder (6 x 3 in), these labels make organizing your finances simple and stress-free. Whether you’re just starting your budgeting journey or you’re a seasoned saver, these labels help you take control of every dollar.

What’s Included:</strong…

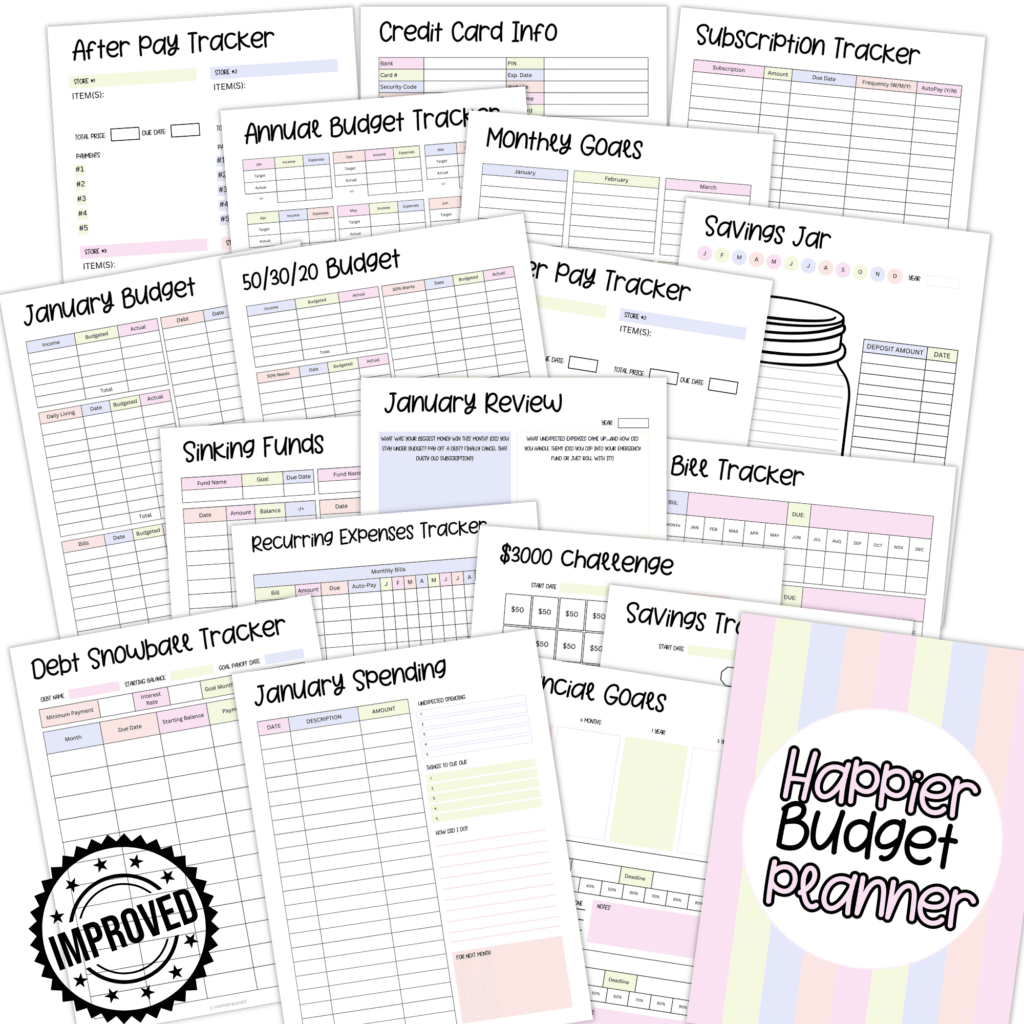

Printable Budget Planner 2 | 95 Pages

Ready to take charge of your money? This 95-page printable budget planner is designed to help you manage every aspect of your finances, from tracking spending to planning for your future. Packed with a variety of budgeting templates, this planner makes it easy to get organized and stay on top of your goals. Whether you’re a budgeting newbie or a pro, t…

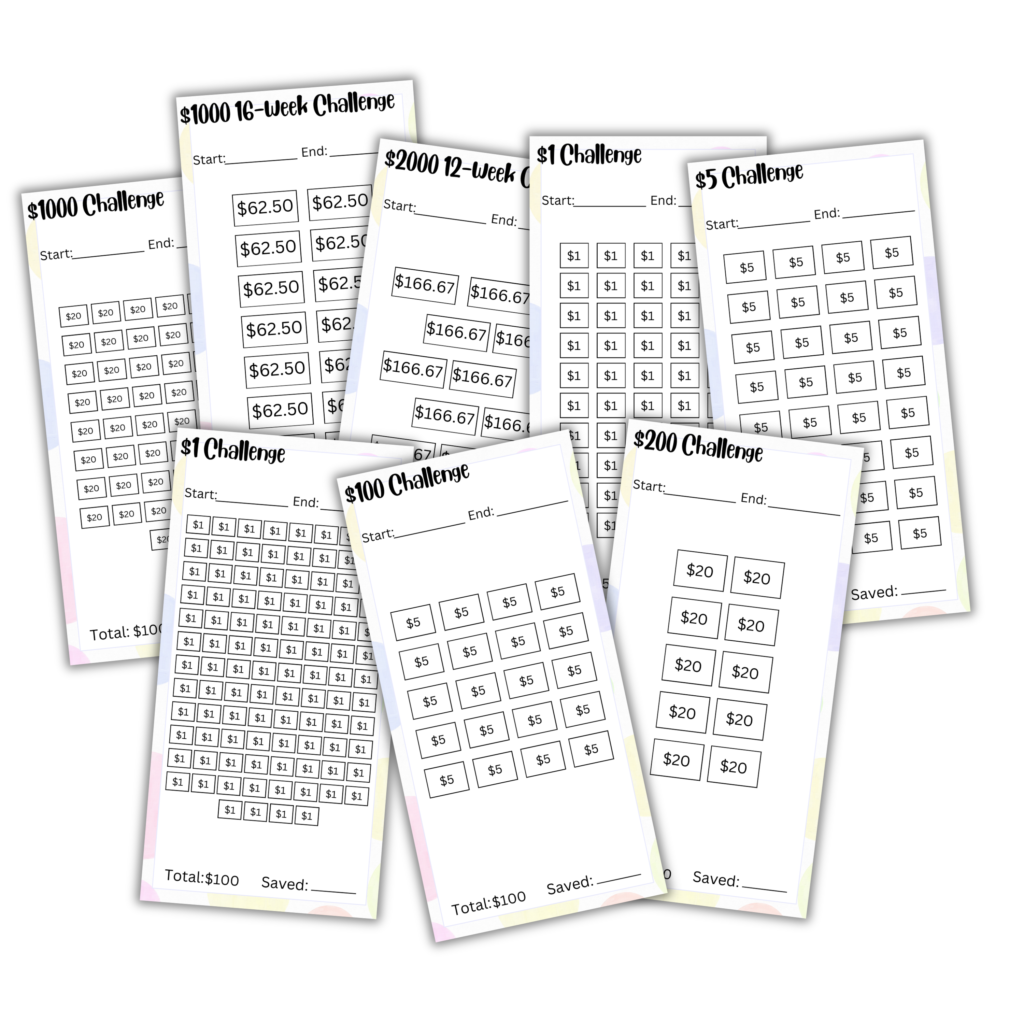

Savings Challenges | 50 Pages

Transform your financial journey with our Cash Envelopes Savings Challenge kit! This comprehensive set of 50 different templates, each measuring 3×6 inches, is designed to help you take control of your finances and achieve your savings goals.

Product details:

- Quantity: 50 unique templates

- Size: 3×6 inches each

- Format: Printable PDF files …