Okay….managing money is a skill every woman needs in her toolkit. Especially when you’re juggling real-life responsibilities like raising kids, running a household, or trying to survive in a city where eggs are basically a luxury item. (Looking at you, NYC.)

As a stay-at-home mom of three living on a single income, I’ve had to learn how to make every dollar stretch. And no, I’m not rich. We’re technically a low-income family. But am I broke? Absolutely not.

I save.

I plan.

I hustle smart.

These are the habits that keep me (and so many other women) afloat. Let’s get into the 10 habits of women who are never broke—and how you can adopt them, too.

1. They Budget Like It’s Their Superpower

Budgeting isn’t boring—it’s how you boss up.. For me, budgeting means sitting down with a cup of coffee and figuring out exactly where our money needs to go. Groceries, homeschooling supplies, utilities, and the occasional family treat—everything gets accounted for. I’ve learned that when you give every dollar a job, it’s harder for them to disappear into thin air.

2. They Plan for Emergencies

If there’s one thing I’ve nailed, it’s planning for the unexpected. Whether it’s a new bed frame, winter clothes for the hubby, or buying a new T.V (because I broke it my mistake one time) having an emergency fund has saved us more times than I can count. Trust me, it’s way better than whipping out a credit card (which, by the way, I don’t even have and don’t plan on getting). Start small if you have to, but start now.

3. They Avoid Debt Like the Plague

Here’s a confession: I have zero credit card debt. Actually, I have zero credit cards. The thought of racking up debt for things I don’t really need stresses me out. If we can’t afford it, we don’t buy it. Period. Living on one income means we’ve had to learn patience, and it’s paid off—literally.

4. They Save Before Spending

The women who are never broke? They save on purpose. We set aside money before anything else. Even a small, automated transfer from my husband’s paycheck into savings keeps us on track.

Out of sight, out of spending temptation.

5. They Live Below Their Means

This is a big one. Even though we live in an expensive city, I’ve learned to stretch a dollar like a pro. We’ve cut out unnecessary subscriptions, shop secondhand whenever we can, and meal plan to avoid takeout. It’s not about deprivation; it’s about making choices that align with what truly matters.

6. They Invest in Their Future

Okay, so I’m still learning about investing, but I know how important it is. Whether it’s contributing to a retirement account or finding ways to grow their income, the focus is on building a better future for their family. Starting small is totally fine—what matters is getting started.

7. They Continuously Learn About Money

I’ve made it a point to learn about personal finance through podcasts and blogs that speak to me (none of that boring corporate lingo!). The more you know, the better you can do. Knowledge is power, and when it comes to money, it’s the kind of power that can change your life.

8. They Set Financial Goals

Whether it’s saving for a new homeschool curriculum or building up their rainy-day fund, having goals keeps them motivated. Writing them down and celebrating small wins along the way makes the process feel less like a chore and more like an adventure.

9. They Maximize What They Have

As a homeschooling mom, I’ve gotten creative with using what we already own. From DIY projects to repurposing items around the house, I’ve learned that you don’t always need to spend money to meet your needs.

10. They Stay Surrounded by Positive Influences

It’s hard to stay on track if you’re surrounded by people who spend recklessly or don’t respect your financial boundaries. I’ll admit, I’m still trying to find friends with the same mentality as me. Surrounding myself with people who value finances, business, and family organization is a goal I’m working on because I know it will help me keep improving in all areas of my life.

Final thoughts

These habits? They aren’t reserved for rich women. Or perfect women. They’re for everyday women who are tired of stressing over money and ready to take control.

Start where you are. Make one small change. Then another.

Because broke is temporary. But financial power? That sticks.

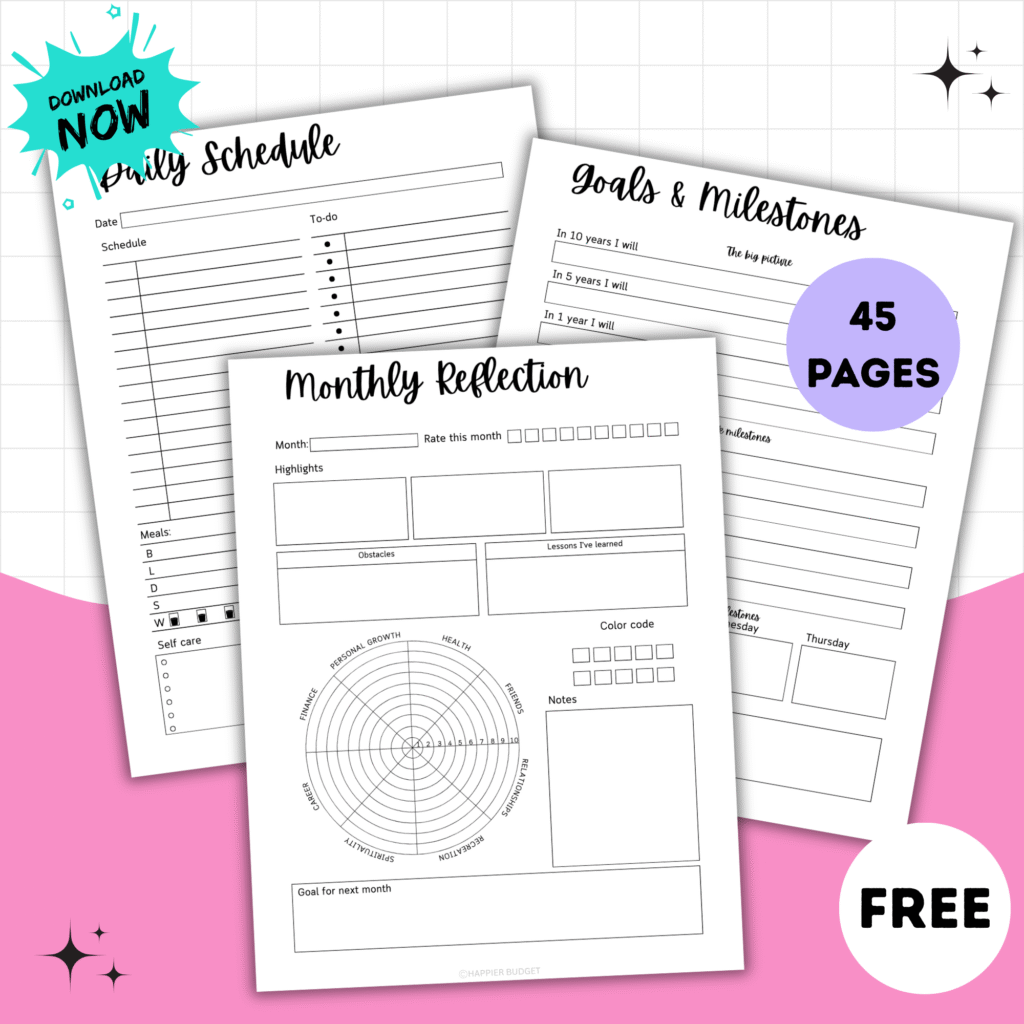

Want to start your own budget? Check out this post here!

You’ve got this.