Table of Contents

Saving money doesn’t have to feel like an impossible mission.

Girl, when we decided to go all in on our savings goal, we made cuts that didn’t feel like punishment. And guess what? We ended up saving $18,000 in one year, on ONE income. Not by winning the lottery. Not by eating ramen every night. Just by being intentional with what we cut and why.

This isn’t about depriving yourself. It’s about spending with purpose and saving like your goals actually matter (because they do).

Here are 10 things we cut that helped us hit that $18K goal—and how you can do the same.

1. Cut Back on Takeout and Dining Out

Listen, I love not doing dishes as much as the next tired mama, but takeout was eating up our money faster than we could say “extra fries.” Once we started meal planning, we saved anywhere from $300-$500 a month.

So, do this instead: easy home-cooked meals, leftovers, and freezer-friendly dinners that still taste bomb on night three.

2. Cancel Unused Subscriptions

You know those sneaky little $6.99 charges? Yeah, they add up. We went through every subscription and kept only Amazon Prime for the free shipping and unlimited photo storage (yes, unlimited photo storage is a real perk!).

You can save $50-$150 a month without feeling like you live under a rock.

3. Say Goodbye to the Car (If Possible!)

We said goodbye to our hooptie and instantly saved $386 a month on car insurance alone. Add in gas, repairs, and parking headaches? It was a win all around.

Could this be you? If you work from home or live in a city with decent public transport, maybe!

4. Lower Your Phone Bill

T-Mobile who? We switched to Mint Mobile and haven’t looked back. Same coverage, half the cost.

Want in? Click the picture below for my personal referral link—it’ll save you money and give me a little love too.

5. Trim Your Grocery Bill

Impulse snacks, name brands, and “just in case” extras were draining us. We started meal planning, buying in bulk, and sticking to our list like our bank account depended on it (because it did).

Real talk: We shaved off $200-$400 a month just being more intentional.

6. Cut Expensive Hobbies

I used to get sucked into subscription boxes and random Amazon carts. Now? We go on walks, do crafts, or hit up free community events.

Savings: $100-$300/month

Still fun? Yup.

7. Reduce Utility Costs

Energy vampires were lurking everywhere. We switched to LED bulbs, unplugged stuff we weren’t using, and negotiated our internet plan.

Results? $50-$150 in savings without turning into cave people.

8. Rethink Travel and Vacations

We would to love trave, but for now? Staycations, local adventures, and saving our coins for that forever home in the DR.

Cutting just one trip: Can free up $1,000-$3,000 for your real dreams.

9. Avoid Impulse Shopping

Ain’t no damn way I needed all those “limited time” sales. Now I sleep on big purchases (30-day rule, y’all) and unsubscribed from store emails.

Savings: $200-$400 a month just by not buying stuff we forgot about two days later.

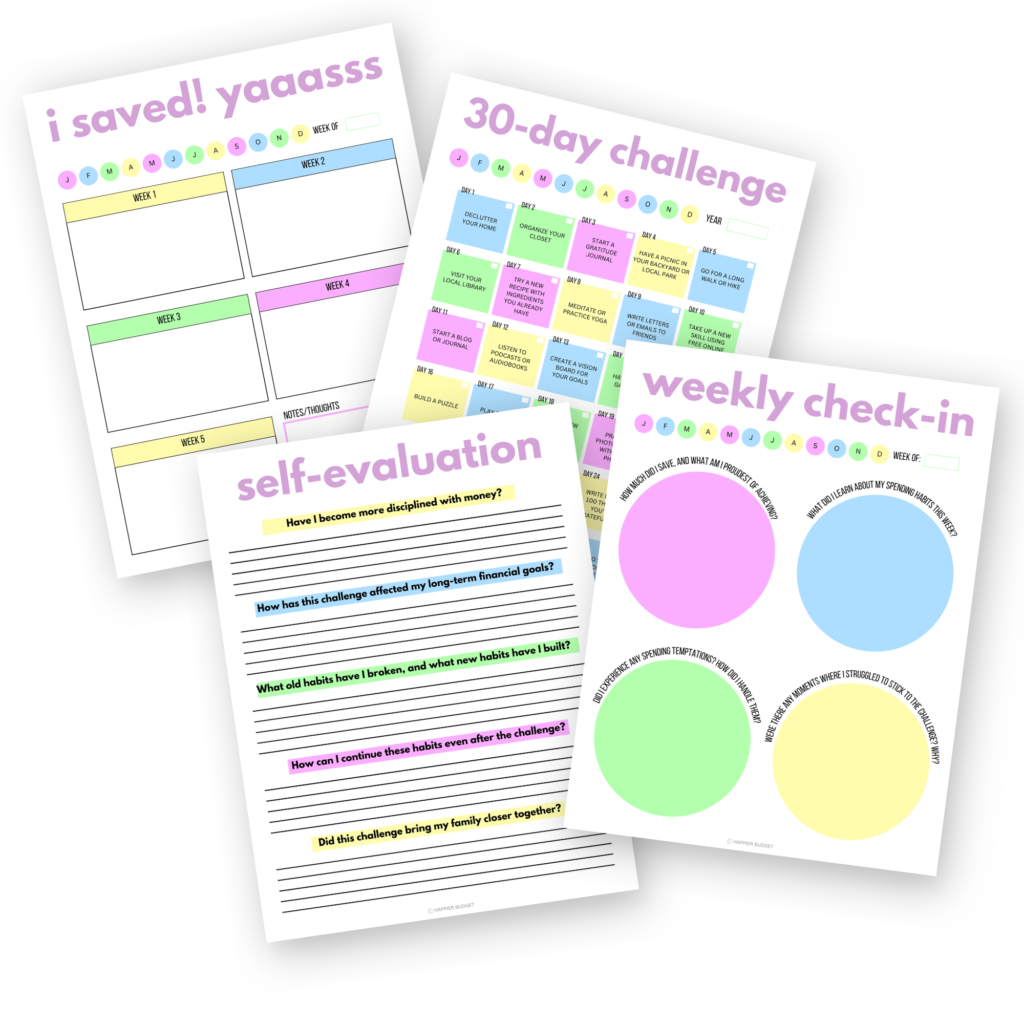

Want to see just how much you can save just by keeping your money in your pocket? Check out my No-Spend Challenge Workbook where I guide and motivate you to not spend any money for 30 days! Read more about it in this post!

10. Spend Less on Gifts and Celebrations

You don’t need to drop $100 on every birthday and holiday. We switched to handmade gifts, $20 limits, and giving quality time over expensive stuff.

Savings: $500-$1,000 a year without sacrificing thoughtfulness.

The Bottom Line: Small Changes Add Up!

We didn’t make all these cuts overnight. We started with one or two, saw the results, and kept going. Before we knew it, we had saved $18,000 in 12 months. No side hustle. No miracle. Just intention, strategy, and a whole lot of “nah, we’re good.”

Ask yourself:

- What can I cut today that I won’t even miss in a week?

- What’s more important: a new gadget or the financial freedom to breathe easy?

Make your money work for you and not against you.

You’ve got this, and I’m rooting for you the whole way.

Ready to get started? Pick one thing from this list and commit to it this week. Just one. Then watch that savings stack up.

So, what’s one thing you can cut today to get closer to your financial goals?