Table of Contents

Mama, if you feel like you’re sinking in debt with no way out, I get it. The weight of bills, loans, and credit card statements can leave you feeling like you’re in over your head. But here’s the truth: you’re not stuck forever. You can get out of this. So, if you’re drowning in debt and wondering how to get out of it without losing your mind, I’ve got the ultimate survival guide for you.

So, let’s start!

1. Stop Adding to the Problem: Cut Out the Spending

Ain’t no damn way you’re going to dig yourself out of this mess if you’re still piling up more debt. The first rule of the “get out of debt” club? Stop spending.

I know, it’s not easy. But trust me, if you keep swiping those credit cards or taking out loans, you’ll never see the light at the end of the tunnel. Take a hard look at your finances and freeze any unnecessary spending—like subscriptions you forgot you had (bye, Netflix), impulse buys, or anything else that’s a “nice to have” but not a “must have.”

This step is critical because every dollar you save goes toward getting you out of debt faster. You’re in survival mode now. Cut anything that isn’t an absolute need.

2. Get Clear on Your Debt: Know What You’re Working With

Now that you’ve stopped adding to the pile, let’s take a deep breath and face the cold hard truth: how much do you actually owe?

This step can be a little scary, but it’s necessary to move forward. Write down every single debt you have—credit cards, loans, medical bills, whatever—and make a list of how much you owe, the interest rates, and the minimum monthly payments.

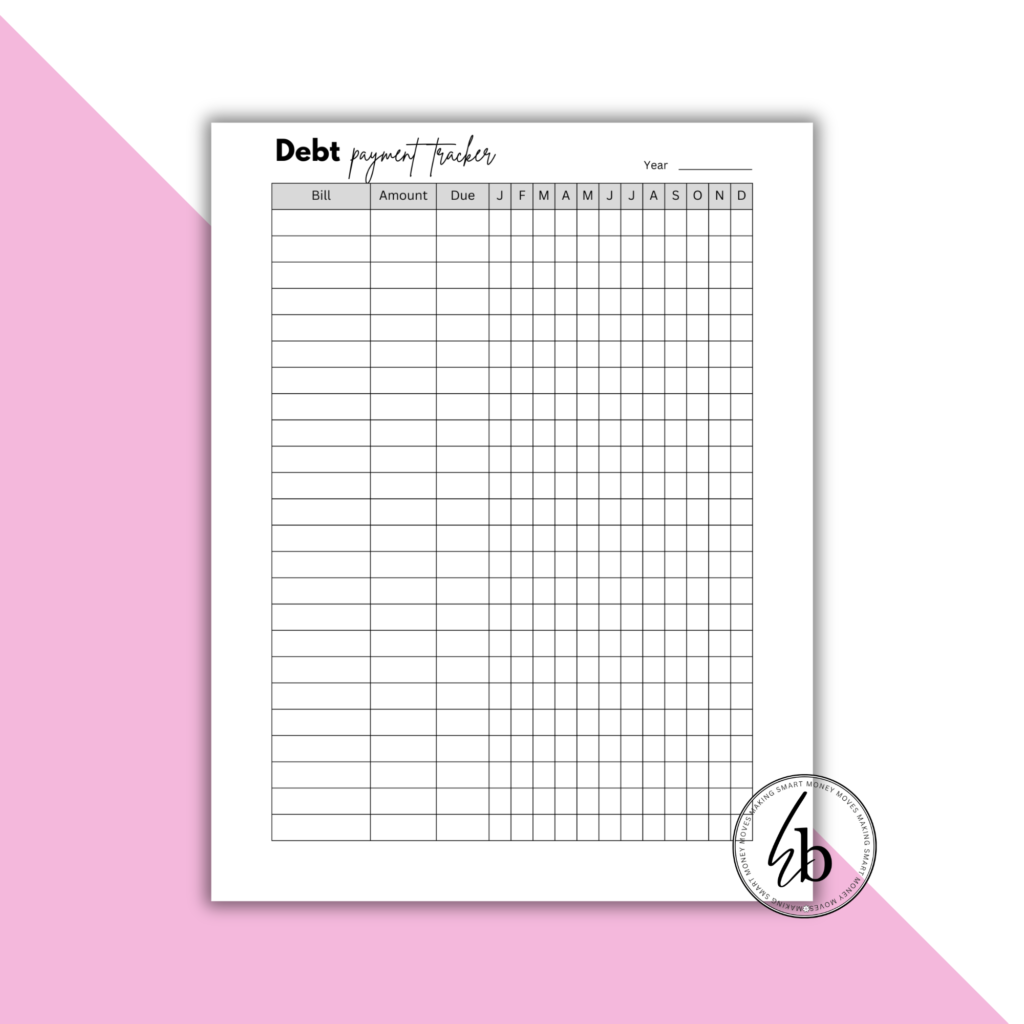

I know it sounds like a lot, but trust me, once you see it all in black and white, it’ll give you the clarity you need to make a plan. And if you need a hand getting it all in order, check out my FREE debt repayment tracker down below. It’ll help you organize everything so you can see exactly where to focus your energy.

3. Prioritize Your Debt: Focus on the High-Interest Stuff

Okay, now that you know exactly what you’re dealing with, it’s time to make a move. You’ve got two main strategies for tackling debt: debt avalanche and debt snowball.

If you’re wondering which one to choose, here’s the deal:

- Debt Avalanche: You pay off the debts with the highest interest rates first. This saves you the most money in the long run because you’re knocking out the stuff that’s costing you the most.

- Debt Snowball: You pay off the smallest balances first. This is great if you need some quick wins to keep your momentum going. It’s more about the psychological boost than the financial benefit.

If you need a little help staying on track, grab my Budgeting Planner or one of my Savings Challenges. They’re designed to keep you motivated and on budget while you focus on tackling that debt.

4. Make a Budget That Actually Works for You

I know, the word “budget” can sound like a drag. But if you’re drowning in debt, it’s absolutely essential. You need a roadmap to follow, and a budget is exactly that.

The good news? Budgeting doesn’t have to be restrictive or boring. It’s all about knowing where your money is going and making sure every dollar has a job. Start by tracking your income and expenses, and then trim the fat where you can. Take a hard look at your discretionary spending and cut out anything you don’t absolutely need. This could mean ditching the takeout or canceling that gym membership you never use.

I get it. Sometimes, budgeting feels like you’re putting yourself on a money diet, but this is your path to freedom. If you’re feeling overwhelmed, I’ve got tools that can help make this process simpler and more fun. Try my simple Budget Planner to get started on the right foot.

5. Negotiate Your Debt: Call Your Creditors

Now, here’s something a lot of people don’t think about: negotiating with your creditors.

Yup, you can actually call up your credit card company or loan provider and ask for a lower interest rate, more manageable monthly payments, or even a settlement option. It might seem intimidating, but trust me, you’ve got nothing to lose.

Start by explaining your situation—be honest. A lot of companies would rather work with you than see you default. Ask for a lower interest rate or inquire about any programs they offer to help with your debt. The worst they can say is “no,” but you won’t know until you ask.

6. Consider Debt Consolidation: Simplify Your Payments

If you’re juggling a bunch of different debts, it might be time to look into debt consolidation. This involves combining multiple debts into one single loan or payment, usually at a lower interest rate.

Debt consolidation can simplify your payments, reduce your interest, and make it easier to stay on track. Just make sure the new loan terms are better than your current situation—otherwise, you’re just delaying the inevitable.

Before jumping into consolidation, check out all your options and make sure the terms work for your situation.

7. Explore Side Hustles: Make Extra Cash to Pay Off Debt

Now that you’ve got your budget in order and you’re prioritizing your debt, it’s time to think about bringing in some extra cash.

I know it’s not always easy to find time to work extra hours or pick up a second job, especially if you’ve got a family to take care of, but even a small side hustle can make a big difference in speeding up your debt payoff.

There are plenty of ways to make extra cash from home—whether it’s freelancing, selling stuff you no longer need, or even turning your skills into a digital product. In fact, if you’re into creating digital products, I’ve got a store where I sell PLR Canva templates that’s perfect for getting started. These can be sold on platforms like Etsy or Shopify, and with just a little bit of effort, you could be making a solid extra income. Check out my PLR shop here!

8. Cut Out Luxuries: It’s Time for a Reality Check

Let’s get real: You’re not going to pay off debt if you’re still living like everything’s fine. Now’s the time to cut out any luxuries and be super intentional with your spending.

That doesn’t mean you have to live like a monk, but take a look at where your money is going. Do you really need that subscription to a service you barely use? Can you make your own coffee instead of hitting up the café every morning?

Every dollar you save gets you closer to being debt-free, so get serious about where your money’s going.

9. Explore Debt Relief Options

If things are really looking bad and you can’t seem to catch a break, you might want to look into debt relief options. This could include working with a credit counselor, consolidating your debt, or even looking into debt settlement.

Just be sure to do your research before jumping in. Some companies promise the world but only lead you deeper into debt. Make sure the program you’re considering is reputable and fits your situation.

10. Celebrate Every Win: Progress is Progress

This whole debt repayment thing? It’s a marathon, not a sprint. So, don’t forget to celebrate each and every small win along the way. Paid off a small bill? That’s huge! Reduced your interest rate? Heck yes! All those little victories keep you motivated and remind you that you’re making progress.

Listen, I get it—getting out of debt can feel like you’re climbing a mountain. But with the right strategy and the right tools, you can totally do this.

Take it one step at a time, stick to your plan, and before you know it, you’ll be standing at the top of that mountain, debt-free and ready for the next chapter.

If you’re ready to start building your plan and stay on track, check out my free debt repayment tracker and printable budgeting planners to make sure you’ve got a solid plan in place.

You’ve got this.