Table of Contents

When I first started budgeting years ago, I had no idea what I was doing. I thought budgeting just meant writing down my bills and making sure I had enough to cover them. But I made one crucial mistake—I didn’t account for when they were due. More than once, I found myself overdrafting my account because I thought I had enough money in my checking account when, in reality, the timing of my bills was throwing everything off.

Another mistake? I used to think budgeting was all about saving. I’d cut back on everything, convinced that was the only way to succeed. But it wasn’t until my big brother sat me down and taught me how to budget correctly (balancing expenses, savings, and debt payoff) that I started making real progress.

If you’ve ever felt like budgeting isn’t working for you, you’re not alone. The good news? Most common budgeting mistakes are easy to fix once you know what they are. Let’s go over five common budgeting mistakes you might be making—and how to turn things around so you can actually see progress.

1. You’re Not Tracking Your Spending

You can’t manage what you don’t track. If you’re just setting a budget but not actually tracking where your money is going, you’re missing a huge piece of the puzzle. This is one of the most common budgeting mistakes that keeps people stuck in the paycheck-to-paycheck cycle.

Start writing down every dollar you spend. Use a simple spreadsheet, a budgeting app, or my Cash Envelope Savings Challenge printable to physically track your spending. Seeing your money leave in real time makes you more mindful of unnecessary purchases.

2. Your Budget is Unrealistic

If your budget leaves no room for fun, emergencies, or those “oops” moments, you’re setting yourself up for failure. One of the most common budgeting mistakes is creating a budget that is too restrictive, making it impossible to follow long-term.

So, be realistic. Give yourself a buffer for unexpected expenses and a small “fun” fund so you don’t feel deprived. If you’re saving aggressively, try a No Spend Challenge Workbook to help you cut back without completely restricting yourself.

3. You’re Not Budgeting for Irregular Expenses

We all remember to budget for rent, groceries, and utilities, but what about those non-monthly expenses? Things like car maintenance, holiday gifts, and annual subscriptions can throw your budget completely off if you don’t plan for them. This is a common budgeting mistake that leads to unnecessary stress and last-minute financial struggles.

Do this instead: Create sinking funds for irregular expenses. Set aside a little money each month for things like car repairs, birthdays, and yearly fees. Using a cash envelope savings method can help you visually see your progress and prevent last-minute financial stress.

4. You’re Trying to Do Too Much at Once

Paying off debt, saving for a house, building an emergency fund, and trying to live your best life all at the same time? That’s overwhelming—and it’s probably why your budget feels impossible to stick to. A common budgeting mistake is spreading your money too thin, making it hard to achieve any financial goal efficiently.

Just focus on one major financial goal at a time. Use a debt repayment tracker to stay on top of your payments if getting out of debt is your priority. If savings is your focus, try a cash envelope savings challenge to gamify the process and keep yourself motivated.

5. You’re Not Adjusting Your Budget When Life Changes

Life happens. Income changes, unexpected expenses pop up, and priorities shift. If you’re using the same budget month after month without adjusting, it’s no wonder it’s not working for you. Not adapting to life changes is a common budgeting mistake that can lead to financial setbacks.

Revisit your budget every month. If you get a raise, adjust your savings goals. If expenses increase, find areas to cut back. Your budget should work for you—not the other way around.

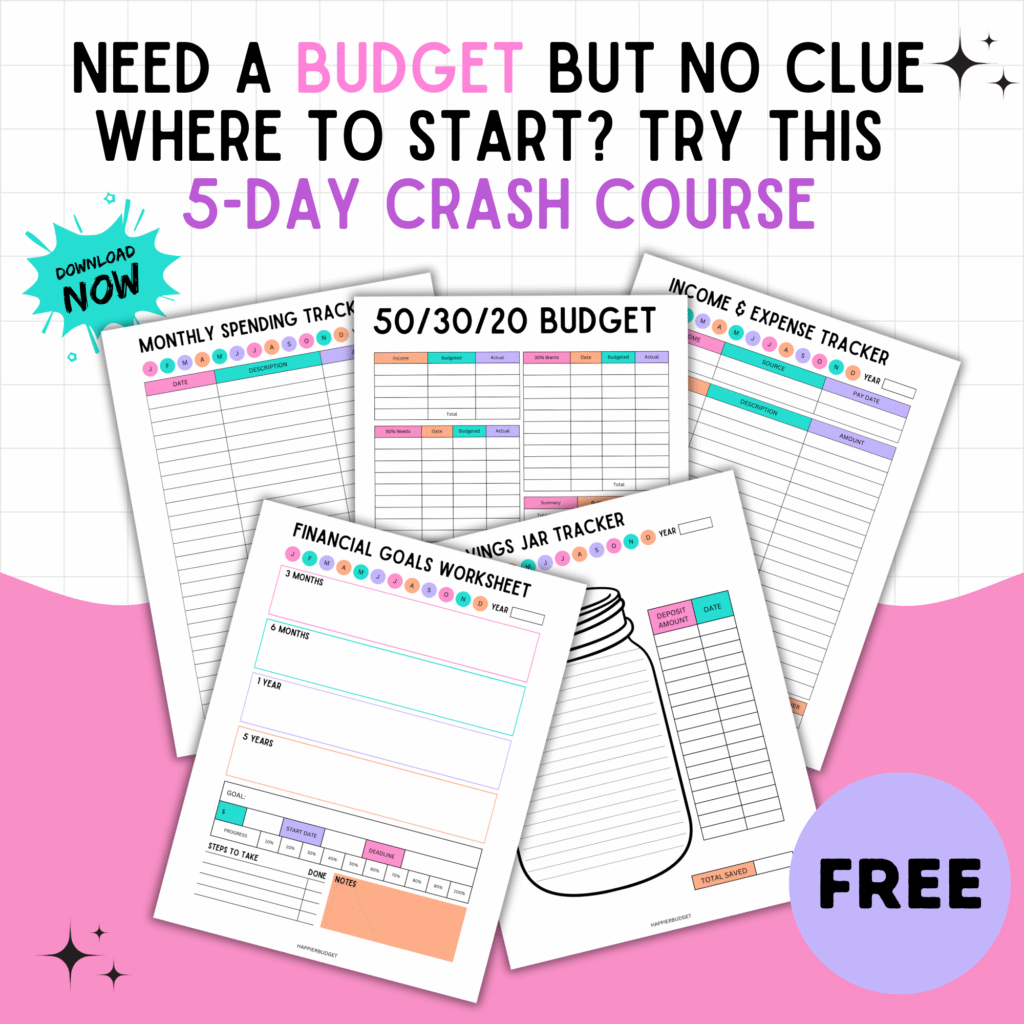

Check out my Happier Budget Planner if you want to track every cent, debt, savings, income and expenses. If you need help starting a budget and actually sticking to it, sign up for my 5-Day Budget Better Crash Course below!

Final Thoughts

Budgeting is all about making progress. If you’ve been struggling to make your budget work, chances are you just need to tweak a few things. Start tracking your spending, set realistic goals, and use the right tools (like my No Spend Challenge Workbook and Cash Envelope Savings Challenge printables) to make budgeting easier and more effective.

Are you making any of these common budgeting mistakes? Let me know in the comments!