Table of Contents

Let me get real with you for a second:

I wasn’t always a budget queen.

When I got married back in 2018, life hit fast. My husband and I were living with my mom and siblings, trying to figure out how to make a single income stretch for a growing family.

And once we decided it was time to get our own place, we knew we had to get serious—fast.

We saved $16,000 in one year.

Moved into our first apartment.

And from there? Budgeting became our superpower (well, mine, since I administer my husband’s paycheck).

Since then, we’ve:

- Saved $7,000 to buy land in the Dominican Republic

- Started working toward saving $33,000 to build our dream home

- Built an emergency fund

- Paid off credit card debt we hated with a passion

But even bigger than the milestones?

Budgeting became our way out of the paycheck-to-paycheck cycle.

It became the strategy behind our dream of escaping the rat race.

It gave me control, confidence, and peace—while raising three kids on one income.

If you’re feeling overwhelmed, stuck, or like your money controls you…

Here are 5 powerful reasons to start a budget—and how it might change your entire life.

1. Gain Total Control Over Your Money

Ever check your bank account and think: “Where the heck did it all go?”

Been there. Lived there. Didn’t love it.

Budgeting gives every dollar a job…before it disappears.

It helps you make intentional choices with your money instead of constantly reacting.

You’ll know:

- What you can spend on groceries

- How much you have for fun

- Where to cut back if needed

- What’s safe to save

Budgeting equals clarity. And clarity equals power.

2. Reduce Financial Stress and Anxiety

Money stress is lowkey exhausting.

Bills, surprise expenses, rising prices—it all adds up and weighs you down.

But when you have a budget? You’re prepared.

You’ve got a plan for those bills. You’ve got a buffer.

You stop guessing—and start breathing easier.

The peace that comes from knowing your bills are paid and your savings is growing?

Underrated.

3. Pay Off Debt Without Feeling Overwhelmed

Let’s not sugarcoat it—debt sucks.

Credit card debt? Don’t even get me started. We paid ours off and closed the cards for good.

But the truth is, without a budget, debt can feel endless.

With one? You can pick a method (like snowball or avalanche), make a plan, and actually see progress.

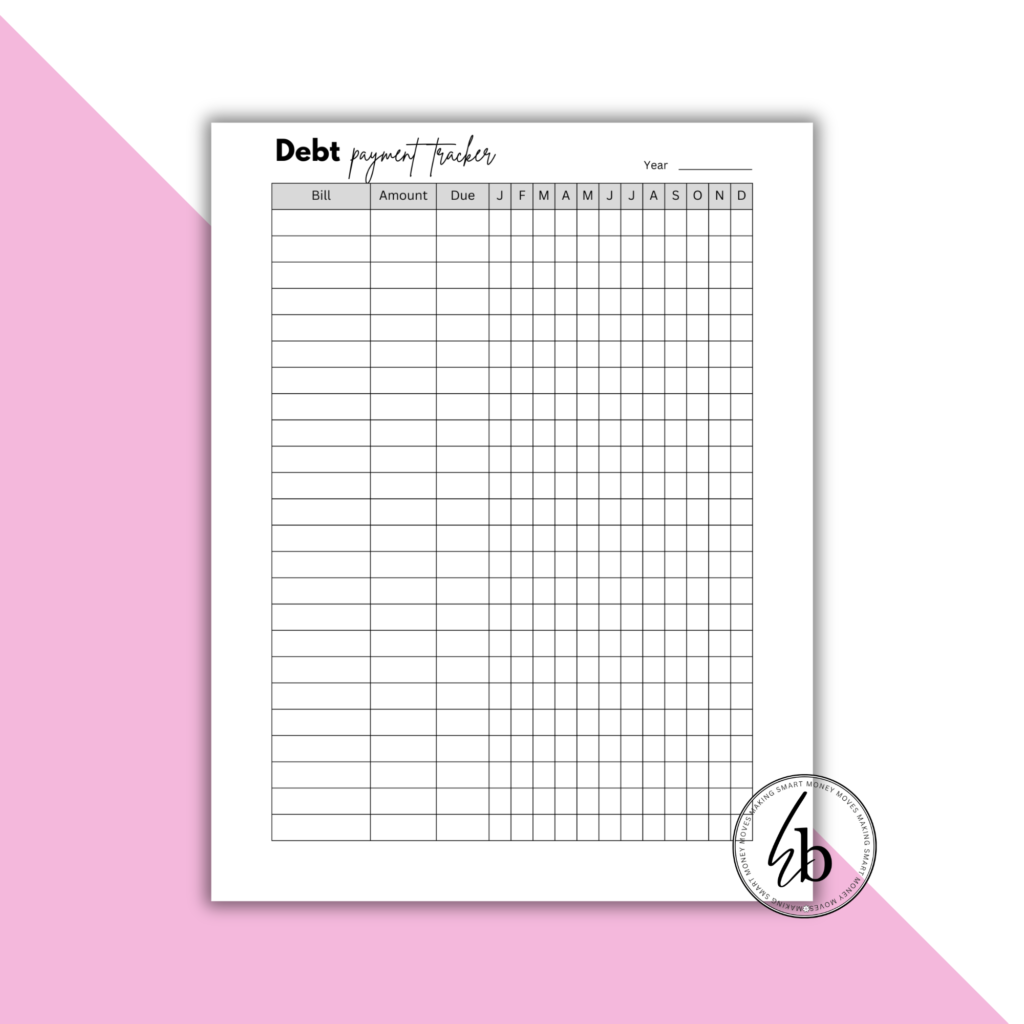

Bonus: I’ve got a free debt repayment tracker to help you map it all out.

No guesswork. Just real momentum.

4. Achieve Your Big Financial Goals

Every single one of our big money wins came down to one thing:

A budget.

Saving $7,000 for land in the Dominican Republic?

Budget.

Building toward $33K for a home?

Budget.

Creating a life that doesn’t rely on swiping credit cards to survive?

Budget.

When you budget, you can break those huge, “how would I ever?” goals into bite-sized steps.

Suddenly that dream vacation, car, or emergency fund isn’t a fantasy—it’s a strategy.

5. Stop Living Paycheck to Paycheck

This life of watching the calendar, hoping the direct deposit hits on time, stressing every time a bill shows up?

You don’t have to live like that.

Budgeting helps you stretch your income, prioritize the essentials, and finally create breathing room.

Even if it’s $20 left over at the end of the month—that’s a win. That’s proof you’re moving in the right direction.

Imagine logging into your bank account and feeling peace instead of panic.

Yeah… that’s what we’re building here.

Final thoughts

You don’t need a finance degree.

You don’t need thousands in savings.

You just need a plan—and the willingness to take that first step.

So let me ask you:

What would your life look like if your money finally made sense?

What would you finally be able to do if you weren’t always catching up?

Start small. Stay consistent.

And trust me—budgeting might just change your life, too.

You’ve got this

Are You Ready to Take Control?

I’m living proof that budgeting works.

I’ve done it while raising three kids, on one income, with big goals and bigger dreams.

We’ve:

- Moved out

- Paid off debt

- Bought land

- Built savings

- Stayed grounded—even when things were tight

And you can too.

If you’re still asking yourself, “Where do I even start?”

Start here:

- Track your income

- List your expenses

- Give every dollar a job

- Stay consistent

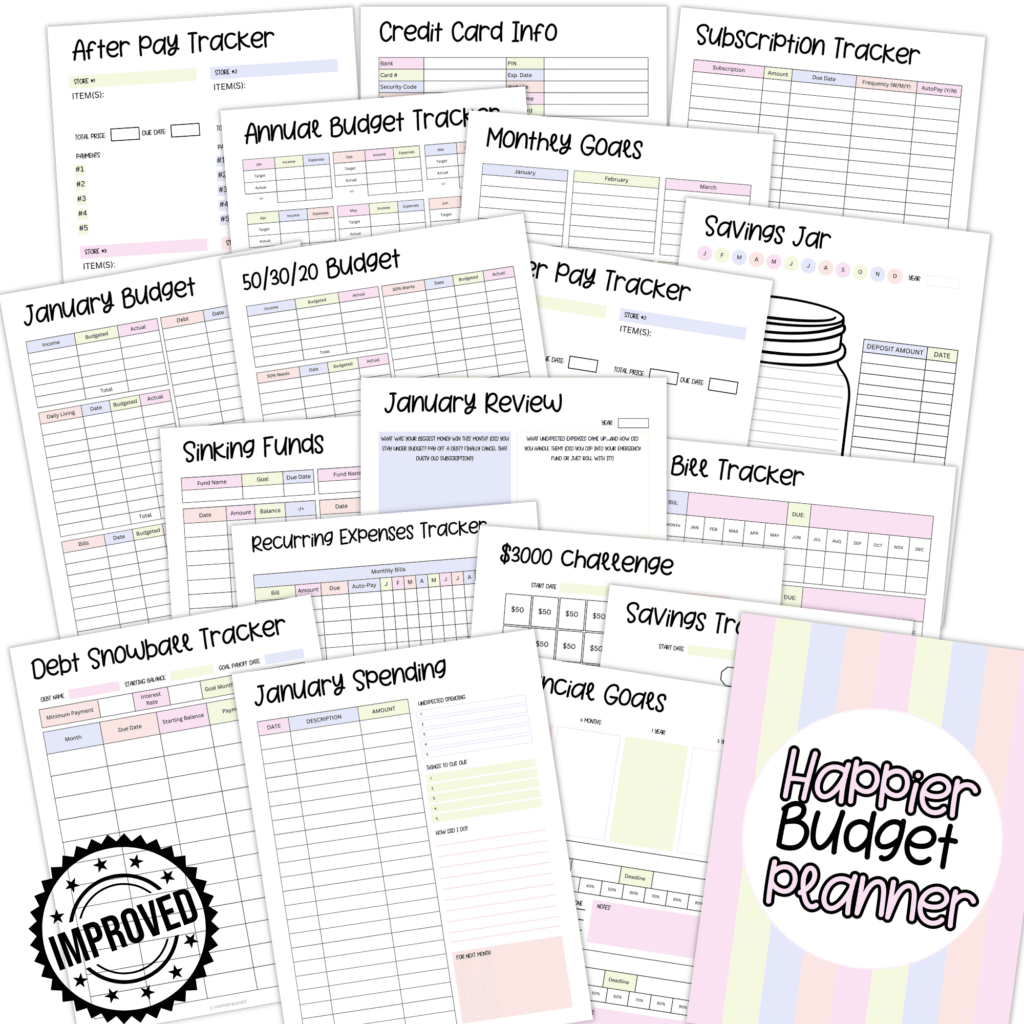

My Printable Budget Planner is perfect if you’re ready to finally take control of your finances.

It’s simple, cute, and designed for real life—not perfection.

Write down your income, expenses, and goals in one place—without the tech headaches.

Printable Budget Planner 2 | 95 Pages

Ready to take charge of your money? This 95-page printable budget planner is designed to help you manage every aspect of your finances, from tracking spending to planning for your future. Packed with a variety of budgeting templates, this planner makes it easy to get organized and stay on top of your goals. Whether you’re a budgeting newbie or a pro, t…

Whether you’re starting from scratch or just need a fresh system, I’ve got you.