Table of Contents

Hey there, friend! Have you ever felt like your financial goals are so far away that you don’t even know where to start? Trust me, I’ve been there. But here’s the good news: setting short-term financial goals gives you quick wins and builds the motivation you need to stay in the game long-term.

So let’s break it down: 5 simple, powerful goals you can start working on today.

1. Build a $1,000 Emergency Fund

Life loves to throw curveballs. Whether it’s a surprise medical bill, a busted tire, or school expenses for the kiddos, a mini emergency fund is a total game-changer.

Get started:

- Aim to save a little at a time. $20/week adds up quick.

- Pause unnecessary spending (those daily $9 coffee runs can chill).

- Sell stuff you don’t use. Decluttering and saving? Yes please.

Imagine, no more swiping a credit card in panic mode. Just peace of mind.

2. Pay Off a Small Debt

Debt is heavy. But knocking out one small balance? Instant confidence boost.

How to get started:

- Pick your smallest debt and go all in.

- Try the debt snowball method (pay smallest balance first).

- Avoid adding more debt while you’re knocking this one out.

That feeling when you see $0 due, is awesome!. Now picture rolling that payment into your next goal.

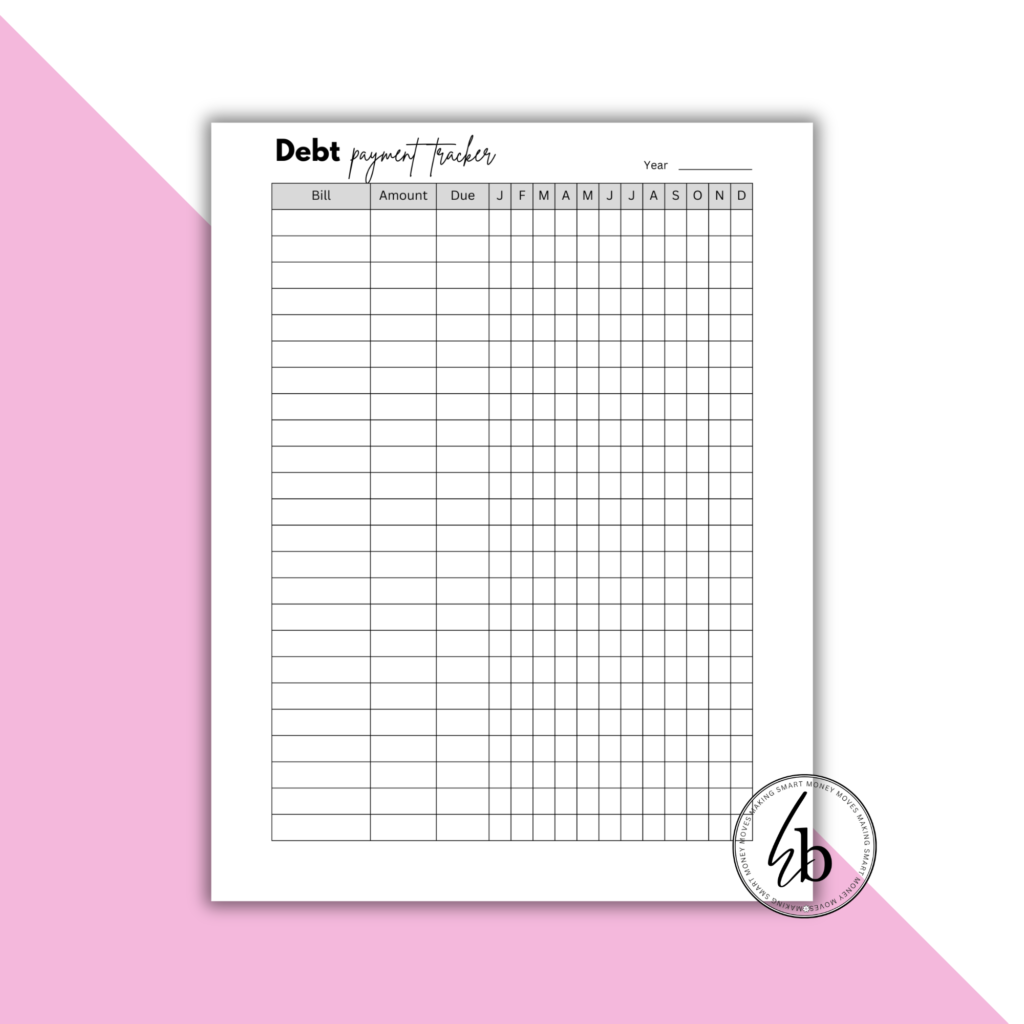

Click the picture below to grab your FREE debt payment tracker and stay on top of your progress!

3. Create a Monthly Budget (And Stick to It!)

Budgeting isn’t about restrictions. It’s about freedom. Knowing where your money’s going means that you will have total control over it.

How to get started:

- Write down your income + all expenses.

- Find areas to cut (subscriptions, impulse buys, etc).

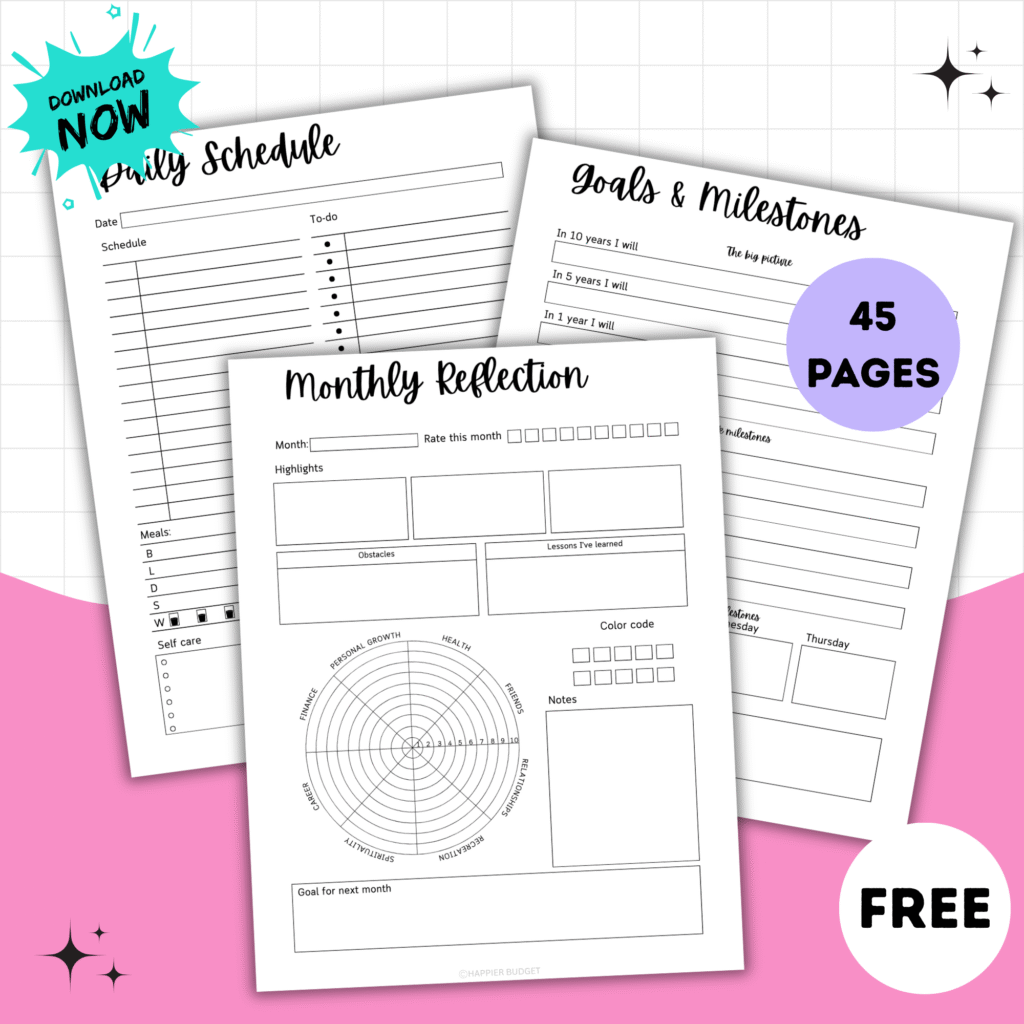

- Use a budgeting app or printable to track it all.

- Reward yourself when you stick to it (within budget, of course).

Ask yourself if your spending line up with your dreams?

Want to get started with budgeting today? Check out my Happier Budget Planner to help you get organized and stay on track!

4. Save for a Specific Purchase

Saving with purpose makes it so much easier to stay motivated. Think: vacation, new laptop, down payment—whatever matters to you.

Quick way you can get started:

- Set a goal and a deadline.

- Open a separate savings account.

- Pay yourself first—treat your savings like it’s a bill.

No more guilt spending. Just joy when you make that purchase with cash.

5. Cut Unnecessary Expenses by 10-20%

We all have those sneaky habits draining our cash—DoorDash, random Target runs, three streaming services you barely use.

How to get started:

- Cancel subscriptions you don’t use.

- Plan your meals (your wallet and your waistline will thank you).

- Buy generic! It’s usually the same stuff, for less.

Want some structure for your no-spend journey? Check out my No Spend Workbook below to help you stay focused and motivated every step of the way!

Small cuts equals major progress.

The Power of Small Wins

These short-term financial goals aren’t just about quick wins—they lay the foundation for bigger dreams. Whether it’s becoming debt-free, saving for a home, or investing in your future, it starts with what you do right now.

So, which one are you starting today?

Picture your life 12 months from now if you begin today. One small goal at a time. You’ve got this!