Table of Contents

Ever feel like your money disappears faster than you can save it? You’re not alone! A lot of people are unknowingly wasting money on things that could easily be cut out or swapped for better alternatives. The good news? You don’t have to live that way. Let’s talk about some of the most common money-wasters and how my family avoids them.

1. Unused Subscriptions

Subscriptions can quietly drain your budget each month. From streaming services to subscription boxes, it’s easy to sign up and forget about them.

What we do: We only have Amazon Prime for $6.99, which gives us free shipping, and Amazon Video Storage for another $6.99 per month for 1TB (because photo storage is free and unlimited). Every dollar counts, so we make sure we actually use what we pay for.

Ask yourself: Do you really use all the subscriptions you’re paying for? Could you live without them?

2. Bank Fees

Banks can sneakily chip away at your savings with maintenance fees, overdraft charges, and ATM withdrawal costs.

What we do: We always use bank ATMs and make sure our checking and savings accounts have zero fees. Paying to access your own money? No thanks!

3. Name-Brand Products

Sure, brand names can feel like a safe bet, but generic products often offer the same quality without the markup.

What we do: We go generic whenever possible, especially for household items. Cleaning supplies, pantry staples, and even some clothing can be just as good (or better) for way less money.

4. Bottled Water

Bottled water is one of the biggest money-wasters out there. It’s literally free from the tap!

What we do: We use reusable bottles and a simple water filter. Saves money and reduces plastic waste.

5. Impulse Purchases

We’ve all been there—grabbing something just because it’s “on sale.” But those little buys add up fast.

What we do: We stick to our shopping list and practice the 24-hour rule before making unplanned purchases.

6. Fast Fashion

Trendy clothes might look good now, but they usually don’t last long.

What we do: We focus on quality over quantity and often swap clothes in local Facebook groups.

7. Eating Out

Dining out regularly can quietly sabotage your savings goals.

What we do: We try our best to cook at home as much as possible and meal plan to avoid the temptation of takeout. But it does feel good to just order from a meal app and not have to wash the dishes, huh?

8. Premium Cable Packages

Let’s be honest—do you watch all those channels?

What we do: We stick to Amazon Prime Video, Netflix and Hulu (we use my sister and brother’s log–in for this! haha) and free content instead of paying for expensive cable packages.

9. Lottery Tickets

The odds are never in your favor, but it’s easy to get caught up in the “what if.”

What we do: We don’t waste money on lottery tickets often—just $20 every six months for fun.

10. Convenience Foods

Pre-cut fruits, frozen meals, and packaged snacks might save time, but they cost way more.

What we do: We prepare our own meals from scratch to keep costs low.

11. Late Fees

Forgetfulness can cost you big time in late payment fees.

What we do: We set up auto-pay and reminders to stay on top of our bills.

12. Expensive Coffee Habits

$2.50 coffee every day? That adds up to serious cash over time.

What we do: We make our own coffee at home and treat ourselves only when needed.

13. New Gadgets

Upgrading to the latest phone or tablet isn’t always necessary.

What we do: We always buy refurbished phones to avoid contracts, extra fees, and taxes. They work just as well for a fraction of the cost.

14. Home Decor Trends

Trends come and go, and spending money to keep up can be draining.

What we do: I don’t spend on home decorations at all. Instead, I find amazing items through Facebook groups that swap household items or give things out for free.

15. Unnecessary Insurance Add-Ons

Extended warranties and unnecessary insurance policies can eat into your budget without offering much value.

What we do: We evaluate our real needs and avoid paying for coverage we don’t actually need.

Final thoughts: Are You Wasting Money Without Realizing It?

It’s easy to fall into the trap of spending on things that don’t really add value to our lives. But when you start questioning your spending habits and making intentional choices, you’ll find that saving money becomes second nature.

Take a moment and ask yourself:

- What unnecessary expenses can I cut today?

- Am I making purchases that align with my long-term financial goals?

- How would my future self thank me for being more intentional with money?

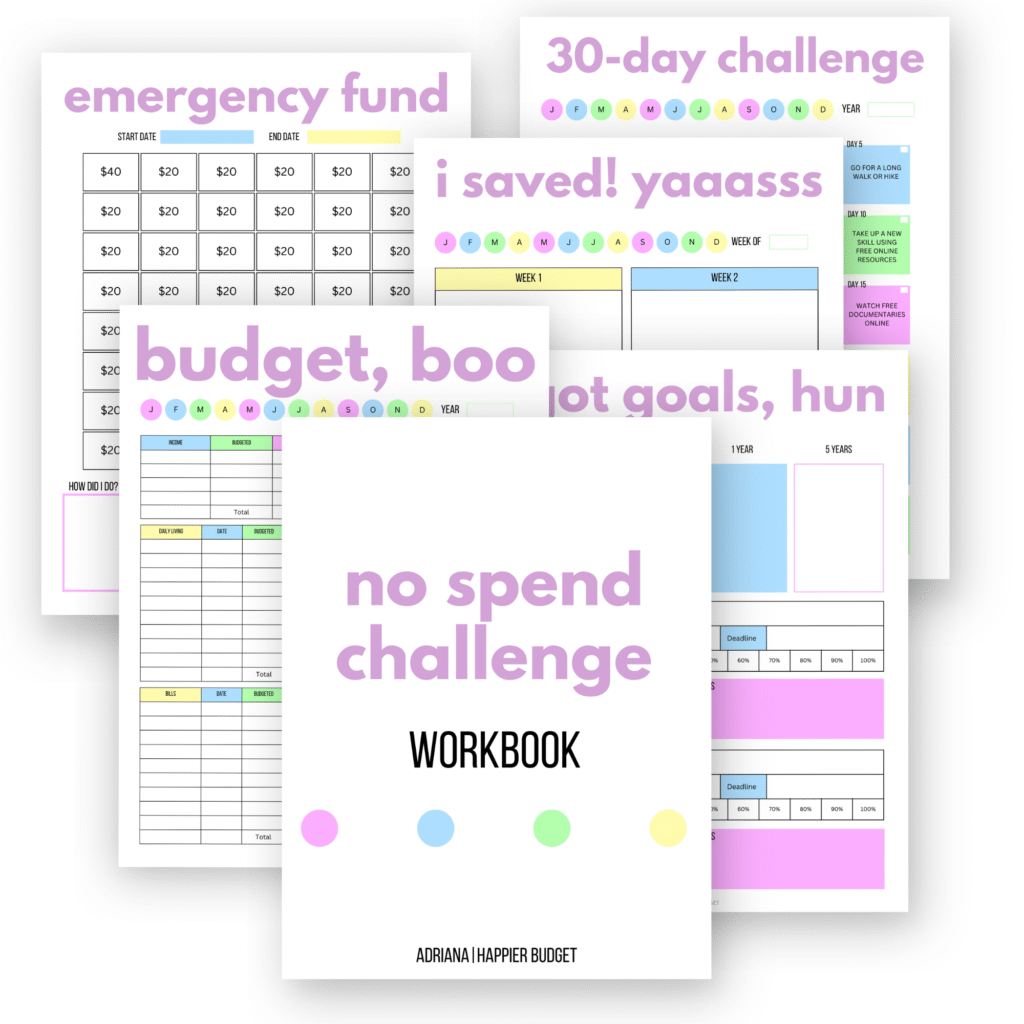

Here’s an idea! Try a no-spend challenge month!

A no spend challenge is exactly what it sounds like—a set period where you cut out all non-essential spending. Think of it as a financial detox that helps you reset your money habits and focus on what truly matters. Grab it below!

Start small, be consistent, and watch your savings grow. You’ve got this!

No Spend Challenge Workbook | 41 Pages

Get my No Spend Challenge Workbook today!

Ready to take control of your finances and finally start saving for the things that actually matter? The No Sp…