Table of Contents

Are you ready to make saving money fun and actually see your progress? A cash envelope savings challenge might be exactly what you need.

Seriously, I do these savings challenges all the time, and let me tell you—they make saving feel exciting. I personally use mine on my iPad now (because: mom life), but if you’re more into that hands-on, old-school vibe? Print them out and go for it! There’s just something about watching your envelopes fill up with real cash that hits different.

What is a Cash Envelope Savings Challenge?

A cash envelope savings challenge is a super simple (and fun!) way to get serious about saving. You set specific savings goals, label envelopes, and regularly add cash into them.

Whether you’re saving for an emergency fund, a birthday, a dream trip, or just a treat for yourself, this method keeps things focused and motivating. You can literally see your progress in real-time—no apps, no guesswork.

Why You’ll Love Using Cash Envelopes

Here’s why I’m obsessed with savings challenges:

- Keeps you accountable: Physical cash = real limits. No mindless swiping.

- Visually motivating: Watching the envelope fill up? Pure dopamine.

- Fits any budget: Whether you’re saving $5 or $100 at a time, you can make it work.

- Totally flexible: Use them for anything—Christmas gifts, debt payoff, travel, or your future dream home.

How to Start Your Savings Challenge

It’s super easy to get going:

- Set your savings goals: Be specific. Want to save $300 for Christmas? Write that down!

- Pick your categories: Think groceries, fun money, travel, debt, etc.

- Print your envelopes: Or go digital if you’re team iPad like me.

- Stuff the envelopes: Add money weekly or with each payday, whatever fits your budget.

- Stay consistent: Make it a habit. And don’t touch the envelopes unless it’s for their purpose.

What’s Included in the Bundle?

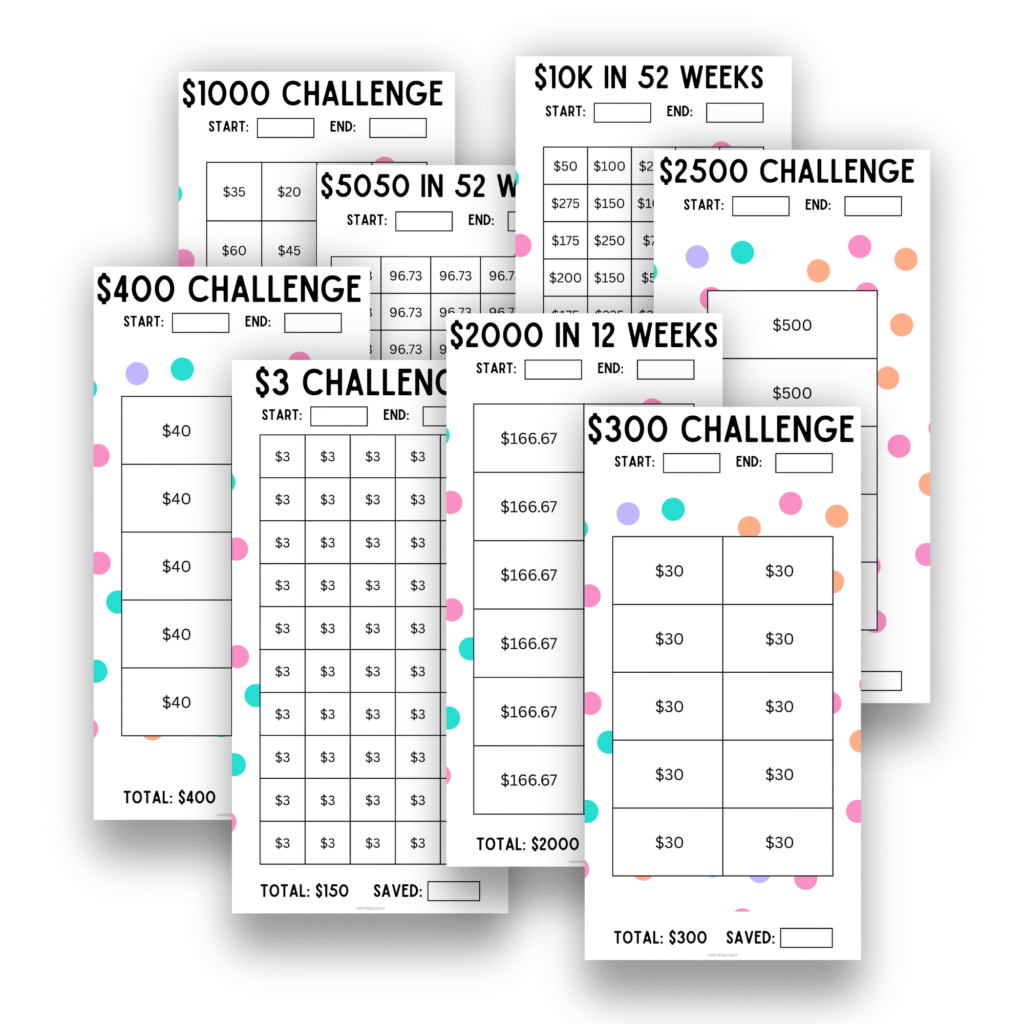

You’ll get all these amazing challenges in the bundle:

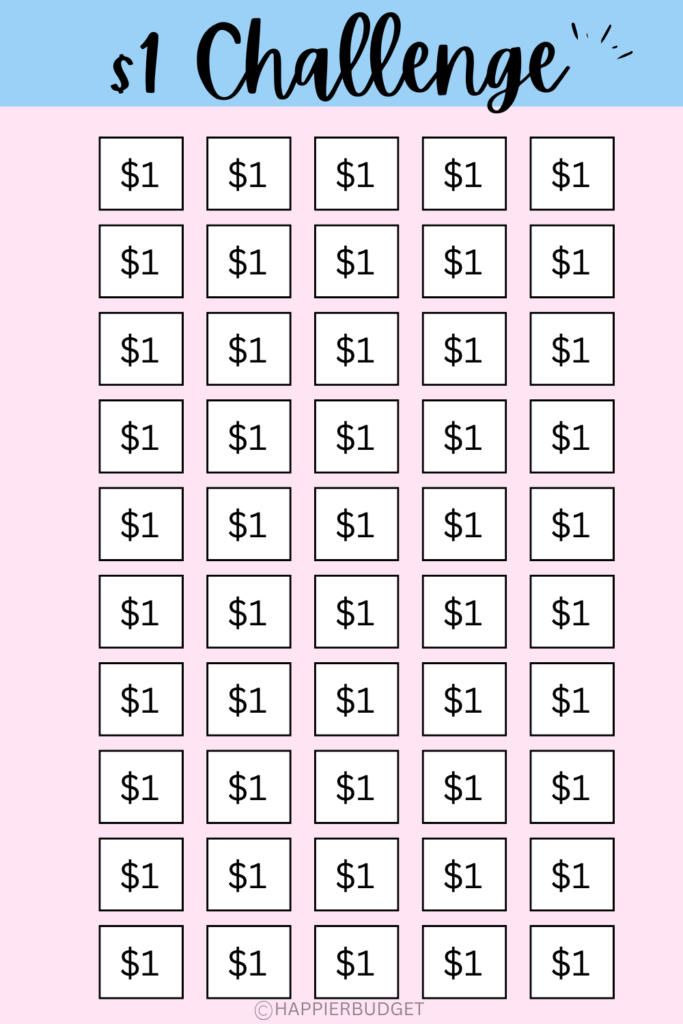

- 2 $1 Challenges

- 2 $5 Challenges

- 2 $10 Challenges

- 2 $50 Challenges

- 2 $100 Challenges

- $20 Challenge

- 5 $500 Challenges

- $200 Challenge

- $155 Challenge

- $300 Challenge

- 5 different $1000 Challenges

- 4 different $2000 Challenges

- $2500 Challenge

- 3 $3000 Challenges

- $4000 Challenge

- $5000 Challenge

- $5050 Challenge

- $5050 in 52 Weeks Challenge

- $50,000 in 2 Years Challenge

- $50,000 Challenge

- $10,000 in 52 Weeks Challenge

- $20,000 in 52 Weeks Challenge

- Emergency Fund

- Christmas Fund

- Valentine’s Day Fund

- Travel Fund

- Baby Fund

- Wedding Fund

- House Fund

- 100 Envelopes Challenge

- Student Loans Fund

Whew. It’s loaded, and you can start with whichever challenge fits your vibe and your budget.

Tips to Stay on Track

I get it—sticking to a savings challenge can be tough, but here are my favorite tips to keep you going:

- Make it a game. Challenge yourself to see how fast you can fill an envelope!

- Keep envelopes in sight. Don’t tuck them away and forget about them.

- Celebrate milestones. Hit a halfway mark? Do a happy dance!

- Get your family involved. It’s even more fun when everyone pitches in!

A few things to watch out for when doing savings challenges:

- Unclear goals: Know what you’re saving for, or it’s easy to give up.

- No essentials budgeted: Don’t skip rent to save for a vacation.

- Dipping into envelopes: Emergencies happen, but try to stay disciplined.

- Quitting too early: Progress is progress, even if it’s slow.

Make it fun & personal!

I love making my cash envelopes my own! You can personalize them with stickers, labels, or fun colors to keep things exciting. If you’re like me and prefer digital, using them on an iPad works just as well!

Ready to Start? Grab Your Savings Challenge Kit!

Grab your 50-template savings challenge pack from my shop and get to stuffing! It’s fun, it’s motivating, and it helps you build real financial momentum.

Saving doesn’t have to be boring. Make it a challenge—and enjoy the journey.

You’ve got this!

Happier Savings Challenges | 75 Pages

Turn saving money into something fun, visual, and actually doable—whether you’re starting with $1 or aiming for $50K.

This isn’t just another printable. It’s a whole mood for your savings goals.

You’ll get <strong data-start="626" data-end="…