Table of Contents

Saving money as a family of five?

Yeah… not for the faint of heart. Between groceries, homeschool stuff, rent, and those “Mami, can we get pizza?” moments—you blink, and half your paycheck is gone.

But my husband and I have always been serious about building a better life. Two years ago, we set a big goal: move back to the Dominican Republic.

And to make that dream happen, we had to save—fast.

Enter: the Envelope Savings Challenge.

Not only did this simple, old-school method help us save $18,000 in just one year, but it also made saving money feel fun. Like, “turn up the music while stuffing envelopes” kind of fun.

If you’re ready to finally reach your savings goals without spreadsheets or stress, I’m about to show you exactly how we did it—and how my Cash Envelope Savings Challenge Bundle can help you do it too.

What is the Envelope Savings Challenge?

The envelope savings challenge is a budgeting method that uses physical envelopes and cash to help you manage your savings goals. Each envelope represents something you’re saving for—whether that’s an emergency fund, a new car, or a family trip.

Once the cash is gone from the envelope… that’s it. No swiping. No “accidental” overspending.

The challenge keeps you disciplined, intentional, and excited to watch your envelopes grow.

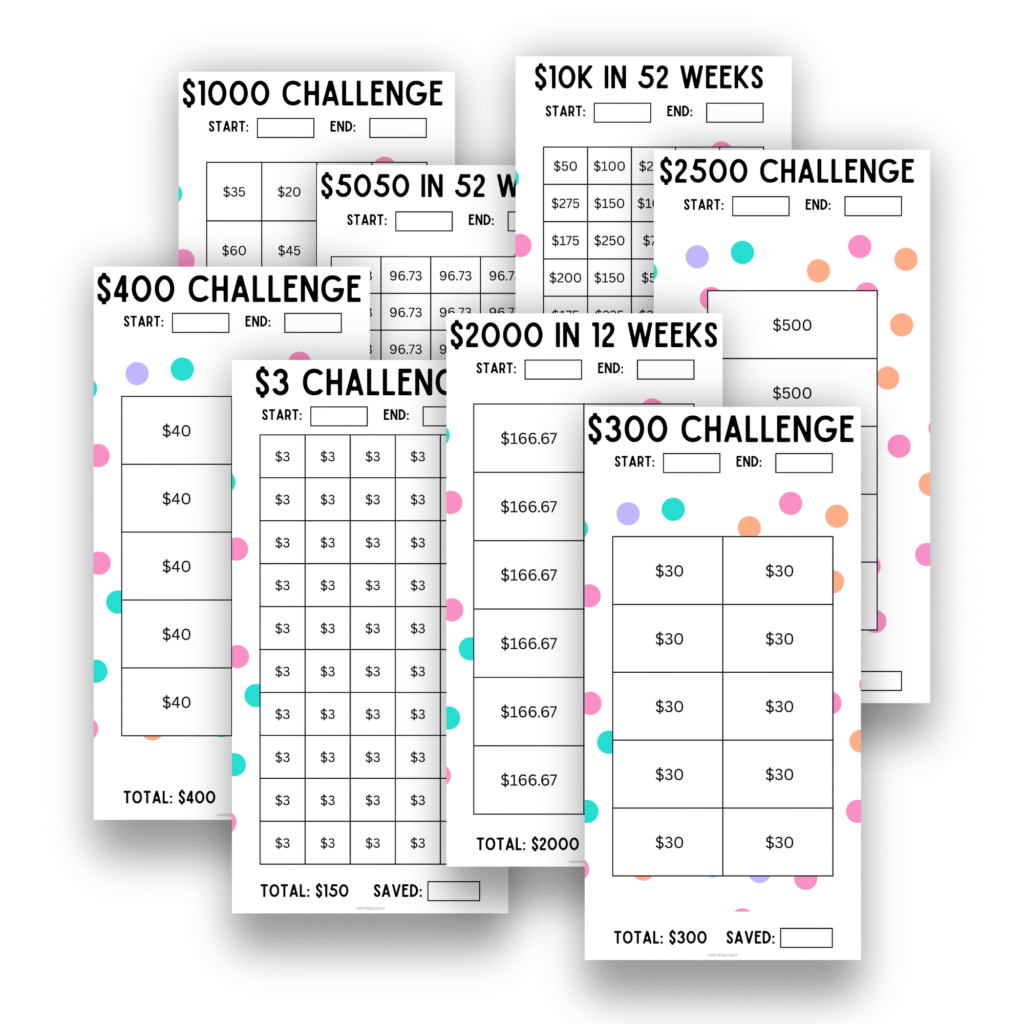

And to make it even easier (and way cuter), I created a Cash Envelope Savings Challenge Bundle with printable trackers for everything—from $1 savings to $50,000 goals.

Why We Used the Envelope Savings Challenge

As a millennial mom, I’ve tried it all—apps, spreadsheets, color-coded systems. And honestly? None of it stuck.

But this method did. Because:

- It’s visual and hands-on (which makes saving actually fun)

- It helped us build discipline with cash

- It got the whole family involved

- It removed the temptation of digital overspending

- It gave us instant progress we could see (and celebrate)

Plus, I paired it with my one of my printable budget planners (that also includes some of the savings challenges!) so I could track income and expenses on paper, down to the cent. That combo? Game-changing.

How to Set Up Your Envelope Savings Challenge

If you’re ready to start saving, here’s the step-by-step to make it work for you.

1. Choose Your Savings Goal

Decide how much you want to save and how fast you want to do it. My Envelope Savings Challenge Bundle includes:

- Small wins: $1, $5, $10, $50

- Mid goals: $200, $500, $1,000, $2,500

- Big goals: $10K, $20K, $50K

- Special funds: Emergency, Christmas, Travel, House, Wedding, Student Loans

No matter your goal, there’s a challenge that fits.

The Full List

- 2 $1 Challenges

- 2 $5 Challenges

- 2 $10 Challenges

- 2 $50 Challenges

- 2 $100 Challenges

- $20 Challenge

- 5 $500 Challenges

- $200 Challenge

- $155 Challenge

- $300 Challenge

- 5 different $1000 Challenges

- 4 different $2000 Challenges

- $2500 Challenge

- 3 $3000 Challenges

- $4000 Challenge

- $5000 Challenge

- $5050 Challenge

- $5050 in 52 Weeks Challenge

- $50,000 in 2 Years Challenge

- $50,000 Challenge

- $10,000 in 52 Weeks Challenge

- $20,000 in 52 Weeks Challenge

- Emergency Fund

- Christmas Fund

- Valentine’s Day Fund

- Travel Fund

- Baby Fund

- Wedding Fund

- House Fund

- 100 Envelopes Challenge

- Student Loans Fund

2. Pick the Right Challenge

New to saving? Start with a $500 or $1,000 challenge.

Saving for something big? Try the $10K, $20K, or even $50K challenge (I’ve got versions that span a year or two—totally doable).

3. Get Your Envelopes Ready

Label your envelopes with the amount or fund you’re working on.

Then print the matching tracker from my bundle and start filling it in as you go!

- Every time you add cash, color it in.

- Every payday, drop in what you can.

- Watch that progress stack up.

4. Make It a Habit

Consistency is key. We made it part of our payday routine:

Groceries. Bills. Savings envelope.

Even if it was just $20 some weeks, we never stopped.

That’s how we got to $18,000.

5. Track Your Progress

This is what makes it fun.

I included over 70 printable trackers in the bundle so you can cross off, color in, or check your way to your goal.

Seeing that visual progress? It keeps you going—even on tough weeks.

Overcoming Common Savings Challenges

Let’s be honest—saving money isn’t always easy. Life happens, and unexpected expenses pop up. Here’s how to tackle some of the common challenges:

1. Temptation to Spend

Keep your envelopes somewhere safe but not tempting. Out of sight does not equal out of mind. Remind yourself why you’re saving.

2. Irregular Income

Save what you can when you can. You can still do the challenge with variable income—just adjust the amounts.

3. Unexpected Expenses

Emergencies happen! That’s why one of the most important challenges in my bundle is the emergency fund challenge. Having money set aside specifically for emergencies will prevent you from dipping into your savings.

4. Feeling Discouraged

Been there. That’s why I made each tracker feel like a game. Celebrate every $10. Every envelope filled. It’s all part of the process.

The Results: How We Saved $18,000

By the end of the year, we had saved $18,000—and here’s what it allowed us to do:

- Save toward a down payment in the Dominican Republic

- Build a solid emergency fund

- Feel confident and secure with money

- Start teaching our kids about money

And honestly? It didn’t feel restrictive. It felt empowering.

Extra Tips for Success

If you’re ready to start saving, here are some tips to make sure you succeed:

- Start with a goal that excites you (not just one that feels “responsible”)

- Involve your family—kids LOVE seeing the envelopes fill up (especially if they know it’s for them!)

- Use cash back, side hustle money, or even spare change

- Adjust your challenge if needed—but never stop entirely

- Celebrate your wins (you’re doing something amazing!)

Final Thoughts

Saving money doesn’t have to be complicated, boring, or stressful.

With the Envelope Savings Challenge, you can make it feel doable.

You can save big—without tracking every cent in a spreadsheet.

If you’re ready to take control of your savings and finally hit those big goals?

This is your moment.

Grab my Cash Envelope Savings Challenge Bundle down below and start building the future you’ve been dreaming about.

You’ve got this.

One envelope at a time

Happier Savings Challenges | 75 Pages

Turn saving money into something fun, visual, and actually doable—whether you’re starting with $1 or aiming for $50K.

This isn’t just another printable. It’s a whole mood for your savings goals.

You’ll get <strong data-start="626" data-end="…