Table of Contents

Do you ever feel like your money just disappears, and you have no idea where it went? You’re not alone. Many people start budgeting with good intentions, only to feel overwhelmed and give up. It’s frustrating to work hard for your money but never feel in control of it.

I get it because I’ve been there. That’s exactly why I created my Mini Budget Planner—a free and simple tool to help you finally take control of your finances without the stress. Nothing complicated, no overcomplicated spreadsheets—just straightforward templates that help you track your money and actually make progress.

Why Budgeting Feels Hard (and How to Fix It)

Most people struggle with budgeting because:

- They don’t have a clear system.

- They try to track too much and burn out.

- They feel guilty about their spending habits instead of adjusting them.

The good news? You don’t have to be a financial expert to stay on top of your money. You just need a simple plan that works for you—and that’s where my Mini Budget Planner comes in.

What’s Inside the Mini Budget Planner?

This free planner (yes, free!) includes everything you need to finally get organized and stick to a budget that works for you. Here’s what you’ll get:

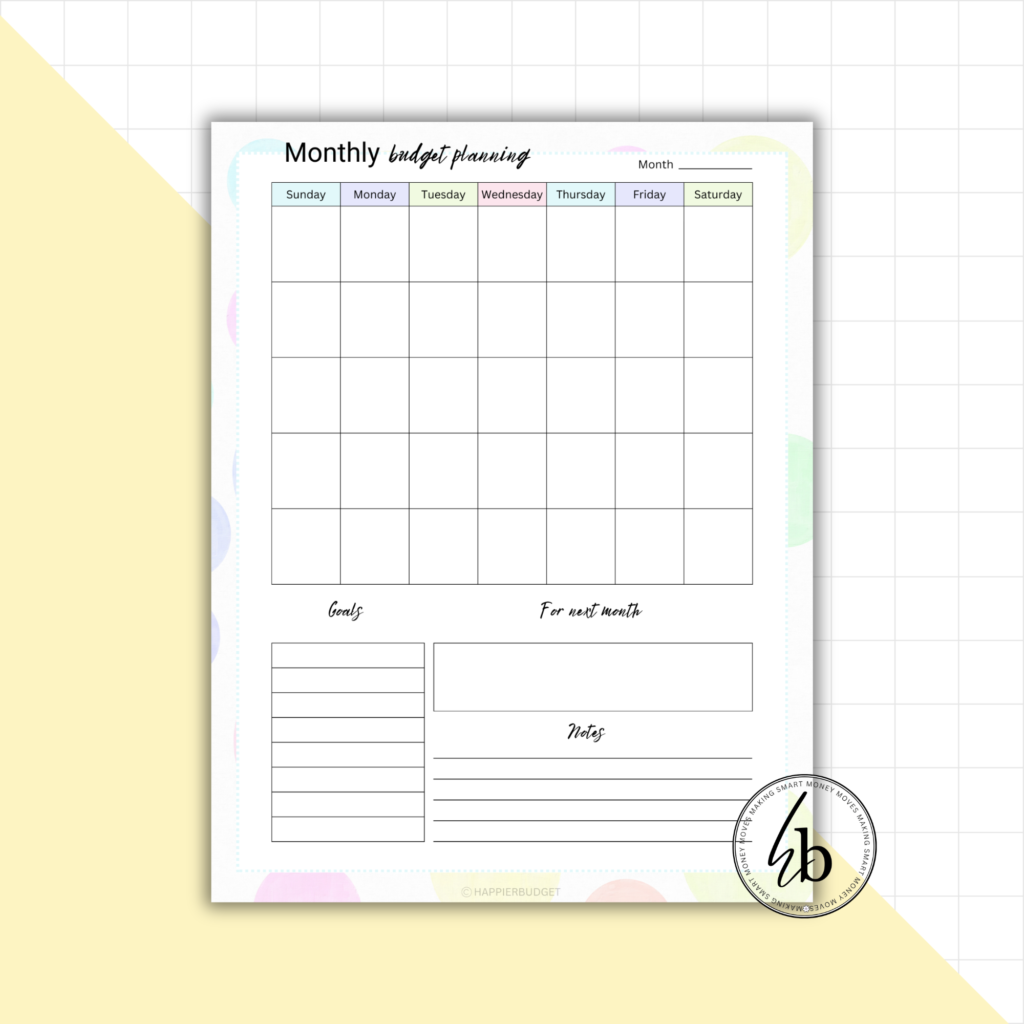

Monthly Budget Planner

This template helps you lay out your entire financial picture for the month. You’ll be able to track your income, fixed expenses, variable expenses, and savings goals, ensuring that every dollar has a purpose. By filling out this planner at the start of each month, you create a clear roadmap to follow, making financial success much easier to achieve.

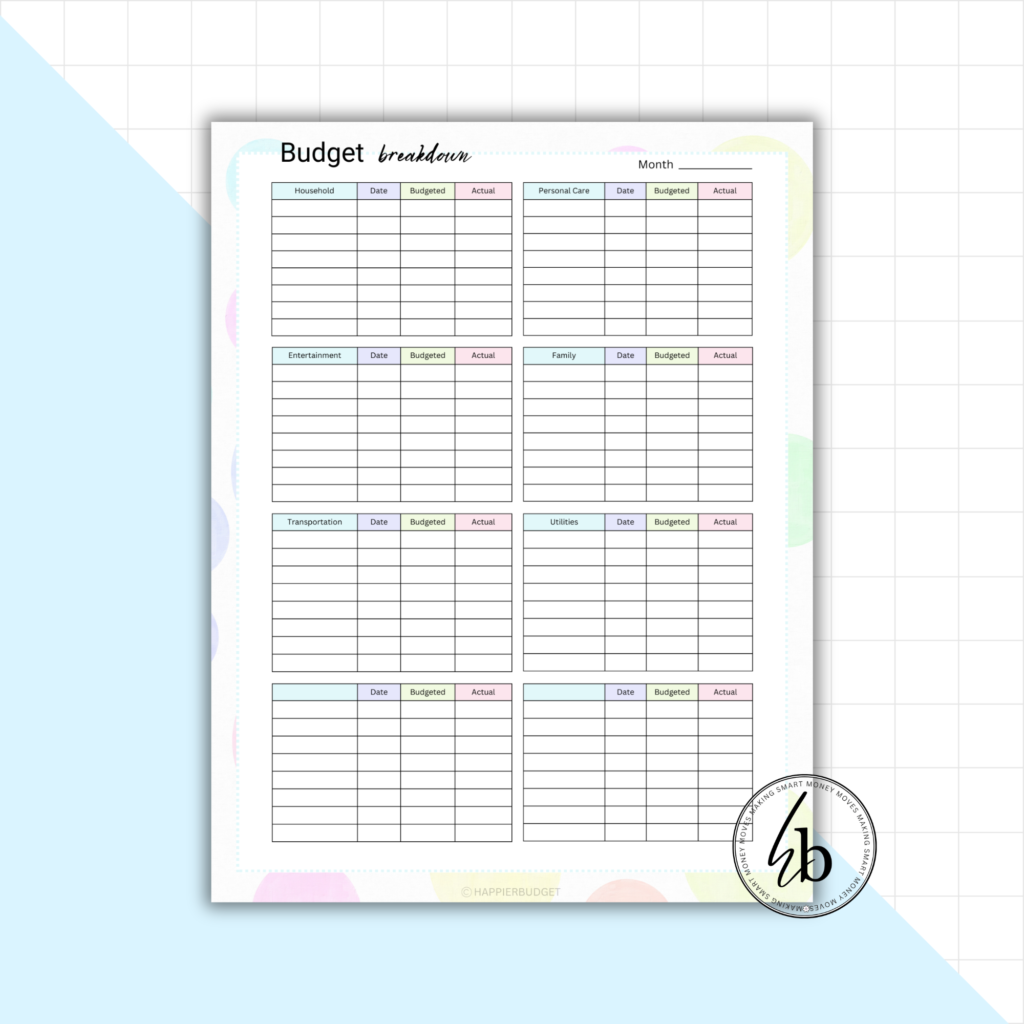

Budget Breakdown

Understanding where your money goes is key to budgeting effectively. The Budget Breakdown template allows you to categorize your expenses into fixed and variable costs, helping you pinpoint areas where you might be overspending. This way, you can make necessary adjustments and free up extra cash for savings or debt repayment.

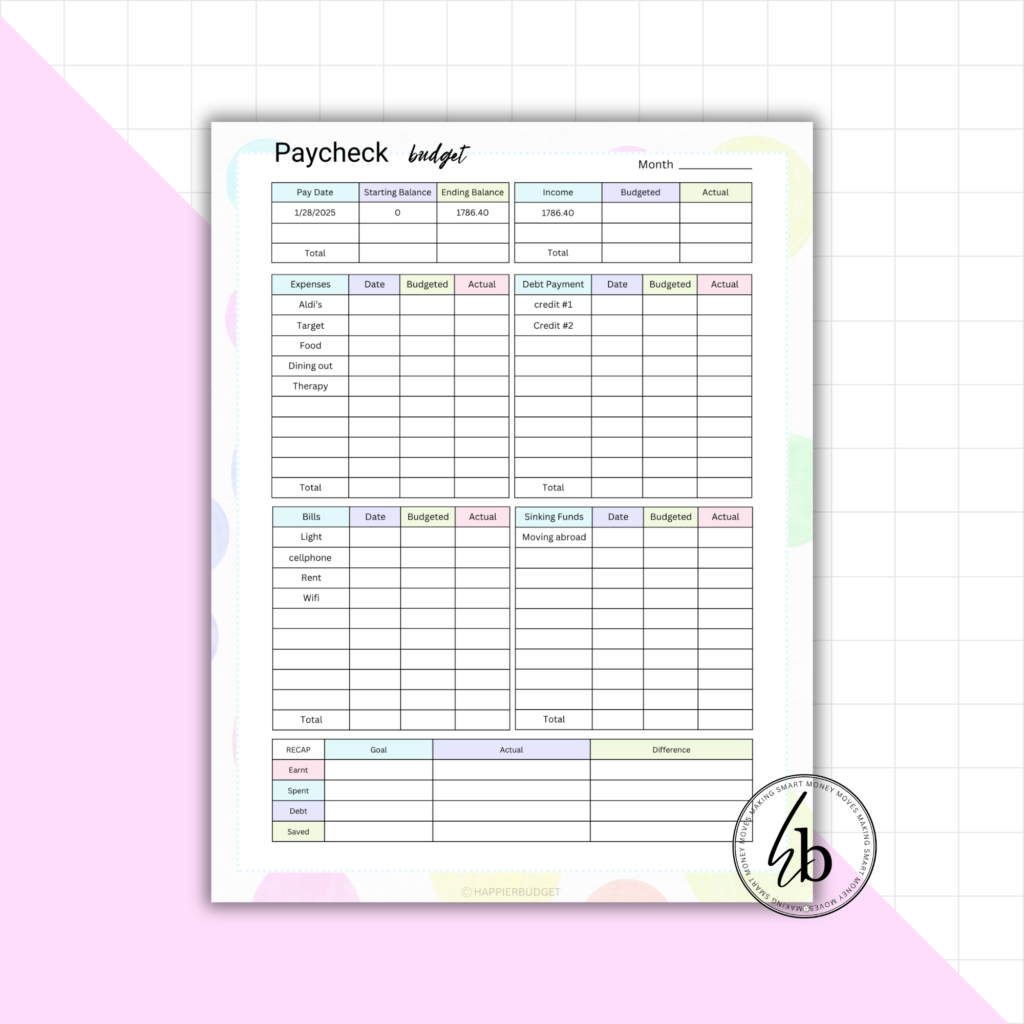

Paycheck Budget

If you get paid weekly, biweekly, or irregularly, this template ensures you allocate your paycheck wisely. Instead of spending mindlessly as soon as your paycheck hits your account, you can use this tool to prioritize your expenses, assign savings goals, and track spending between pay periods.

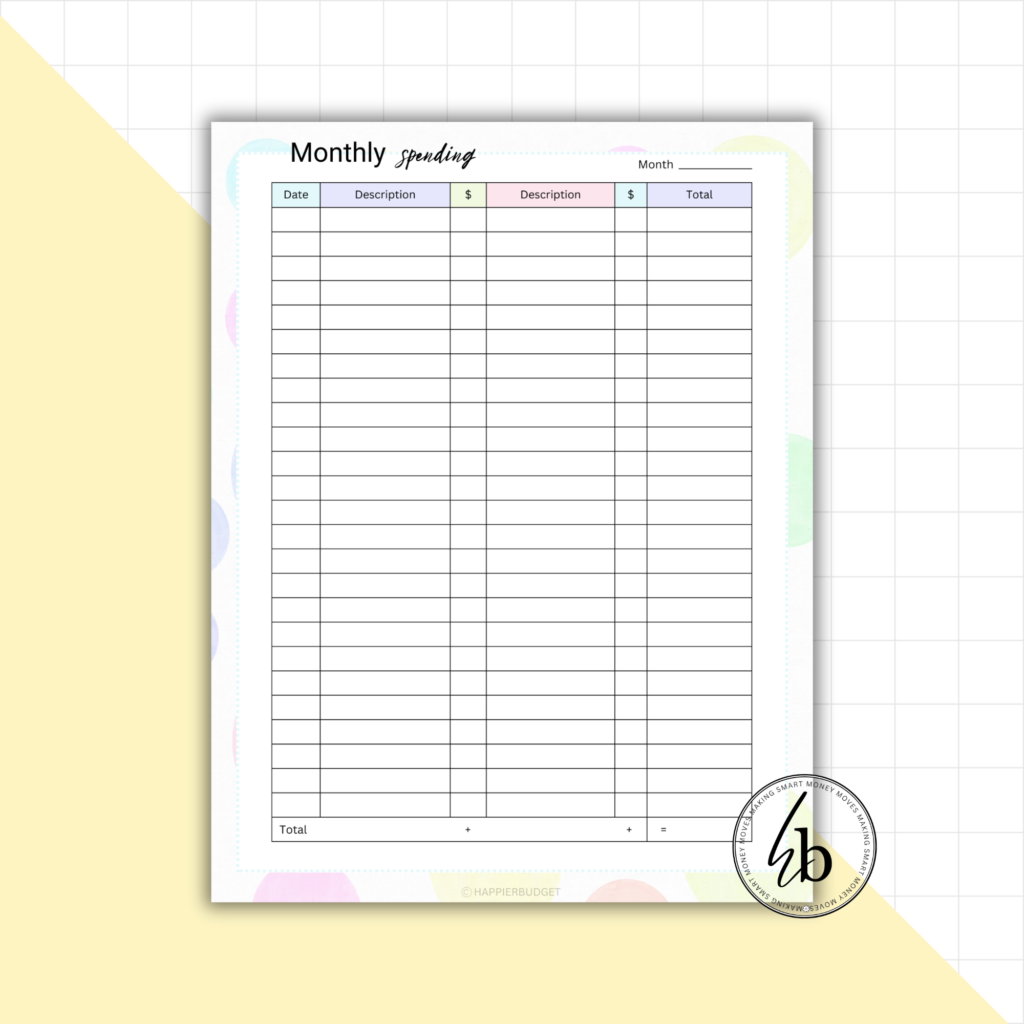

Monthly Spending Tracker

Ever feel like your money disappears, and you don’t know where it went? This tracker is designed to log every expense so you can identify spending patterns. Seeing your expenses written down makes it easier to spot unnecessary purchases and adjust your budget accordingly.

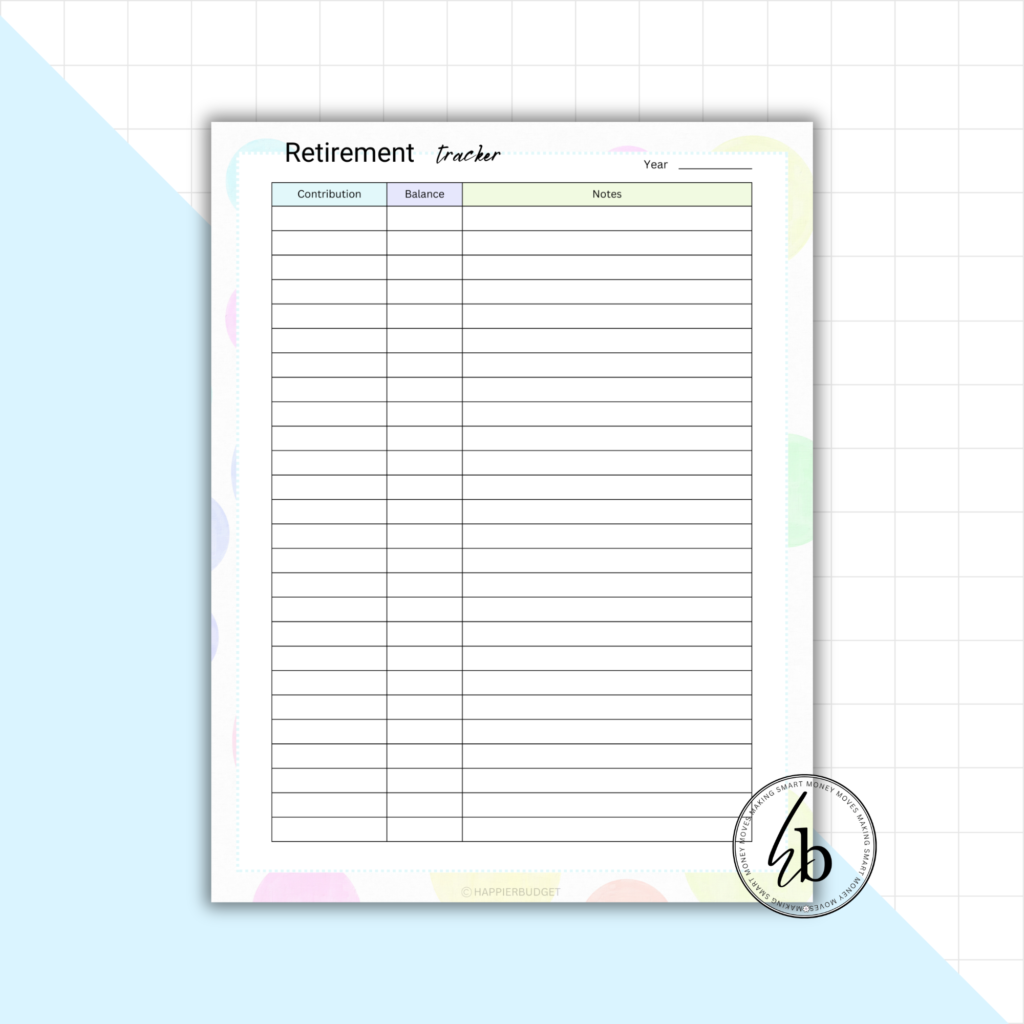

Retirement Tracker

Whether you’re just starting to save for retirement or you’re actively growing your nest egg, this tracker helps you monitor your contributions and progress. Keeping an eye on your retirement savings ensures you’re on track for financial security in your golden years.

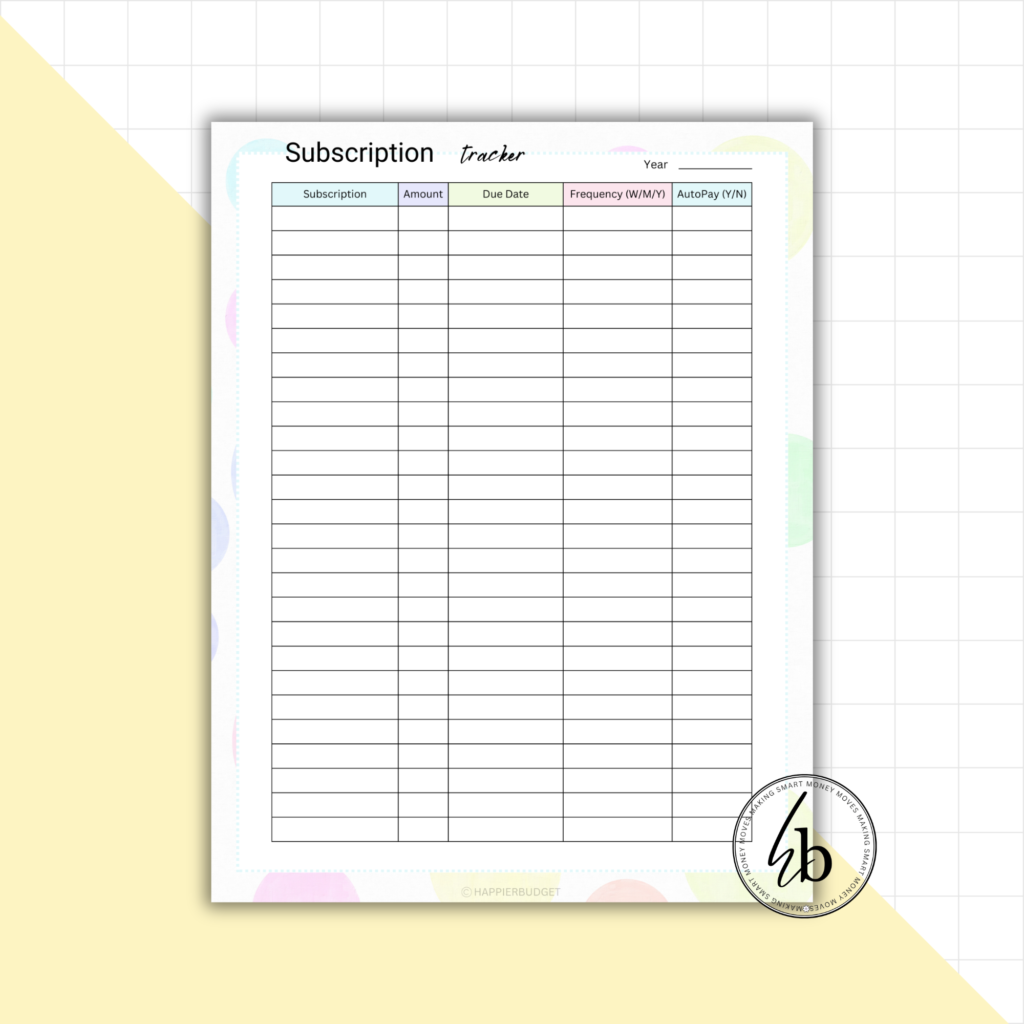

Subscription Tracker

It’s easy to forget about all those little recurring charges—streaming services, gym memberships, software subscriptions. This tracker helps you list out each subscription, its cost, and renewal date so you can decide which ones are worth keeping and which ones to cancel.

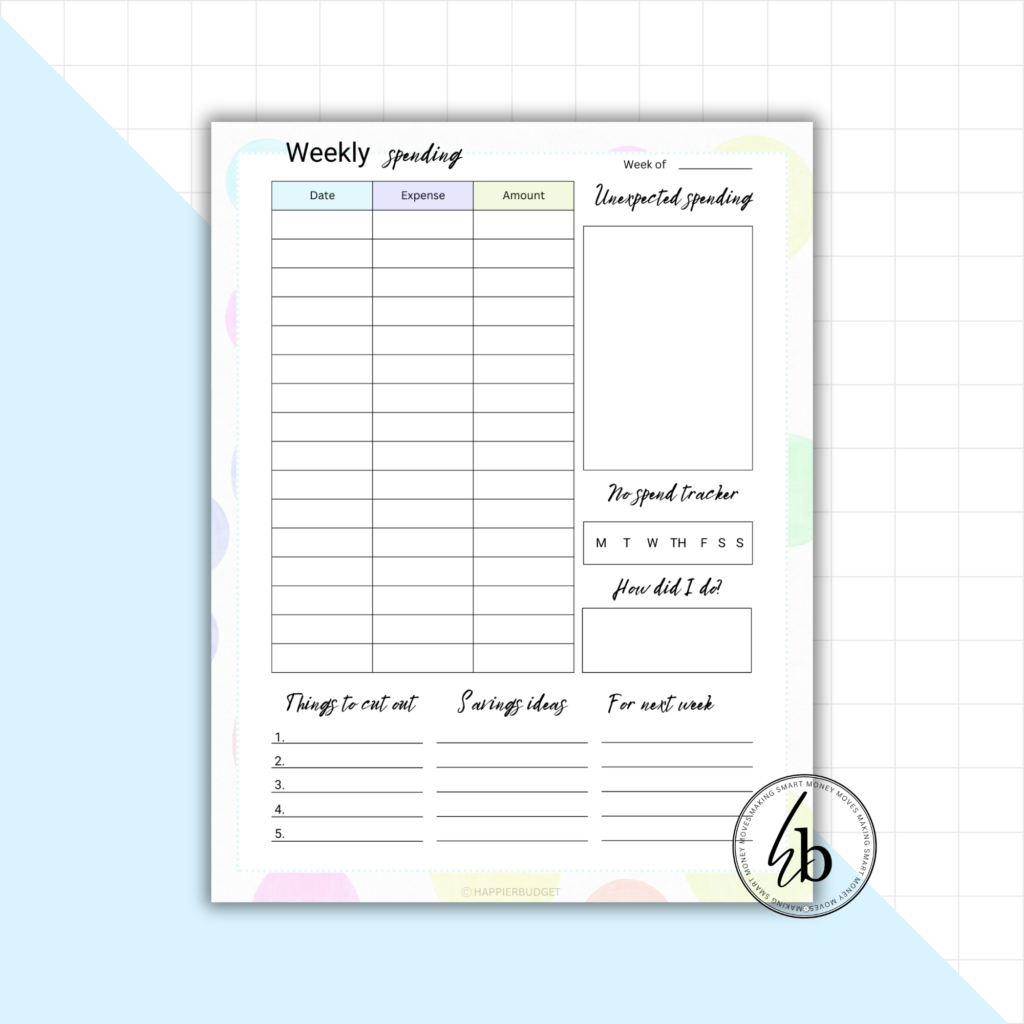

Weekly Spending

Breaking your budget down weekly helps you stay in control of your finances in smaller, more manageable increments. This section allows you to track spending habits week by week, so you can adjust as needed before the month is over instead of realizing too late that you’ve overspent.

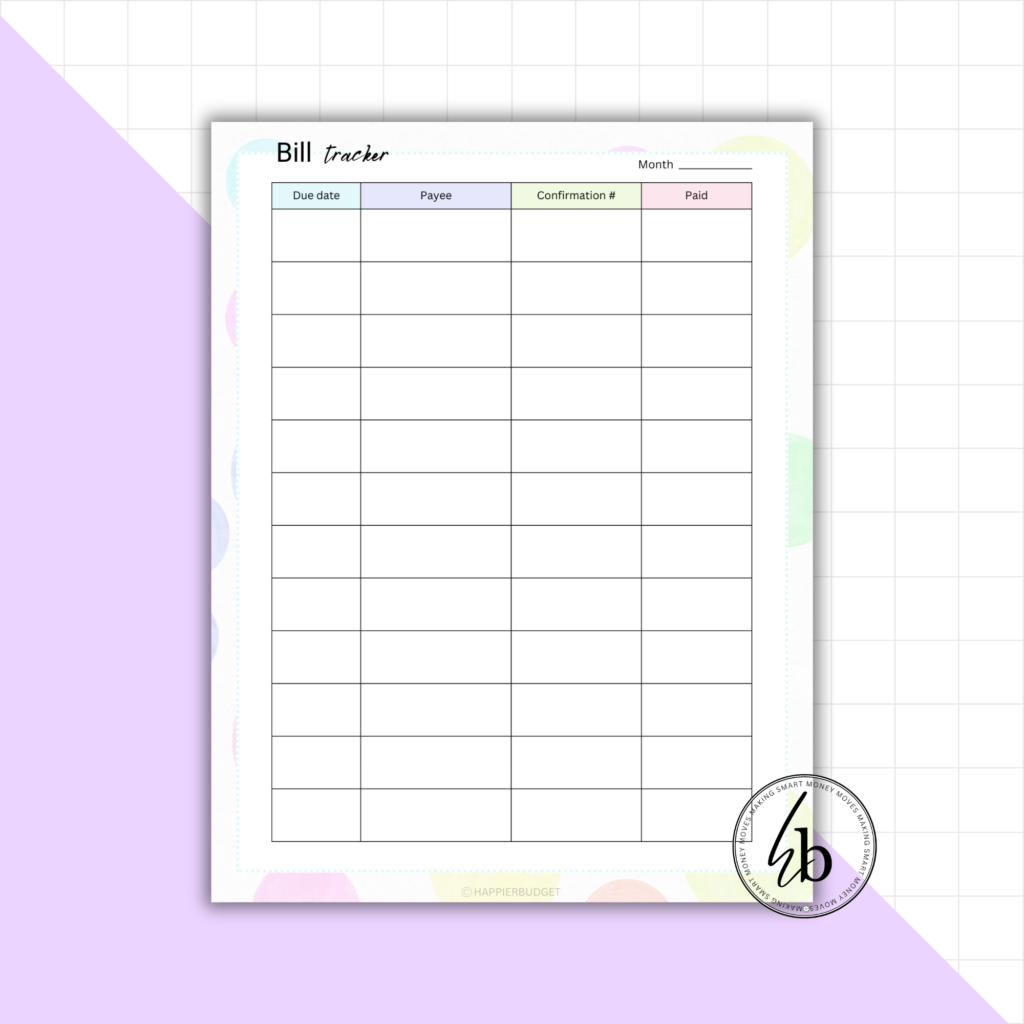

Bill Tracker

Never miss a payment again! This template lets you record all your recurring bills, their due dates, and whether they’ve been paid. Having everything in one place ensures you stay on top of payments, avoid late fees, and maintain good credit.

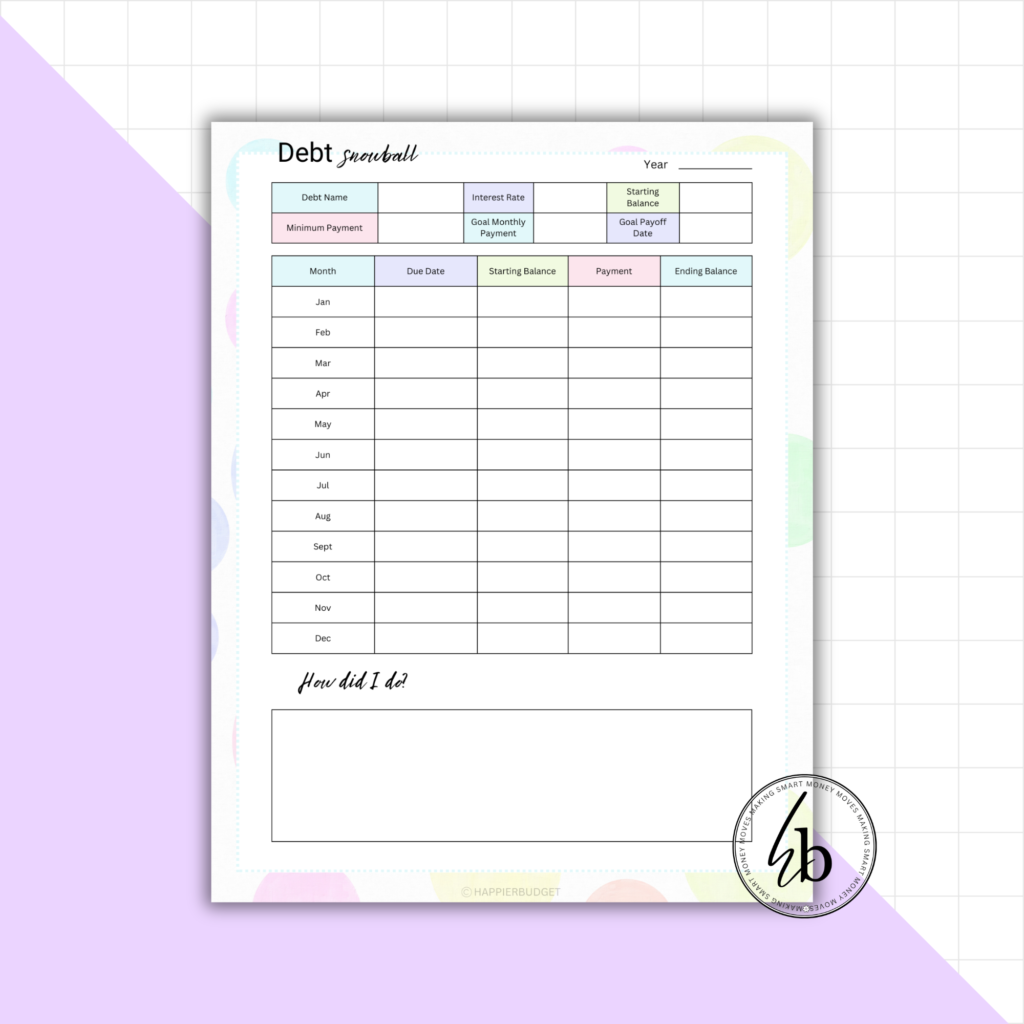

Debt Snowball Tracker

If paying off debt feels overwhelming, this tracker helps you break it down into a step-by-step plan. Following the debt snowball method, you’ll list your debts from smallest to largest and track your progress as you knock them out one by one, gaining momentum along the way.

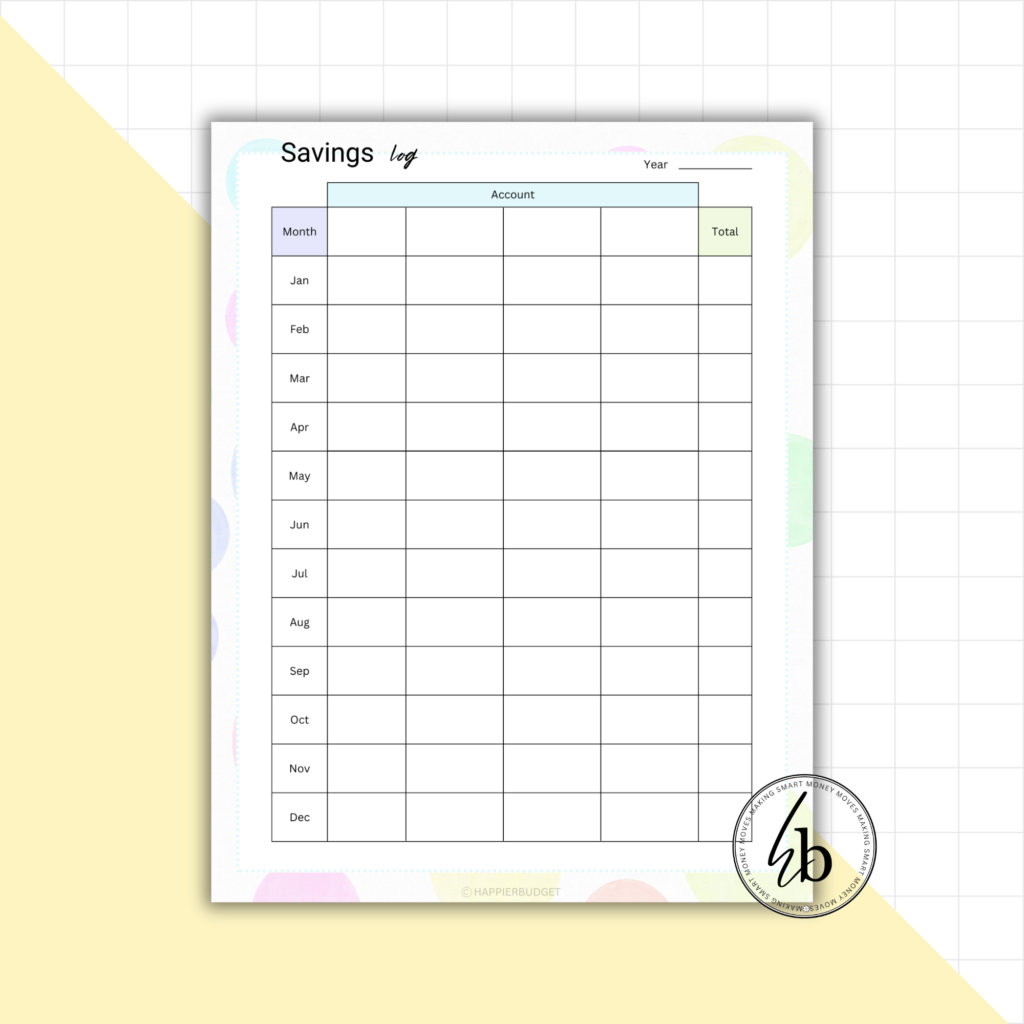

Savings Log

Whether you’re saving for an emergency fund, a vacation, or a big purchase, this log helps you track deposits and monitor your progress. Seeing your savings grow over time is a great motivator to stay disciplined with your financial goals.

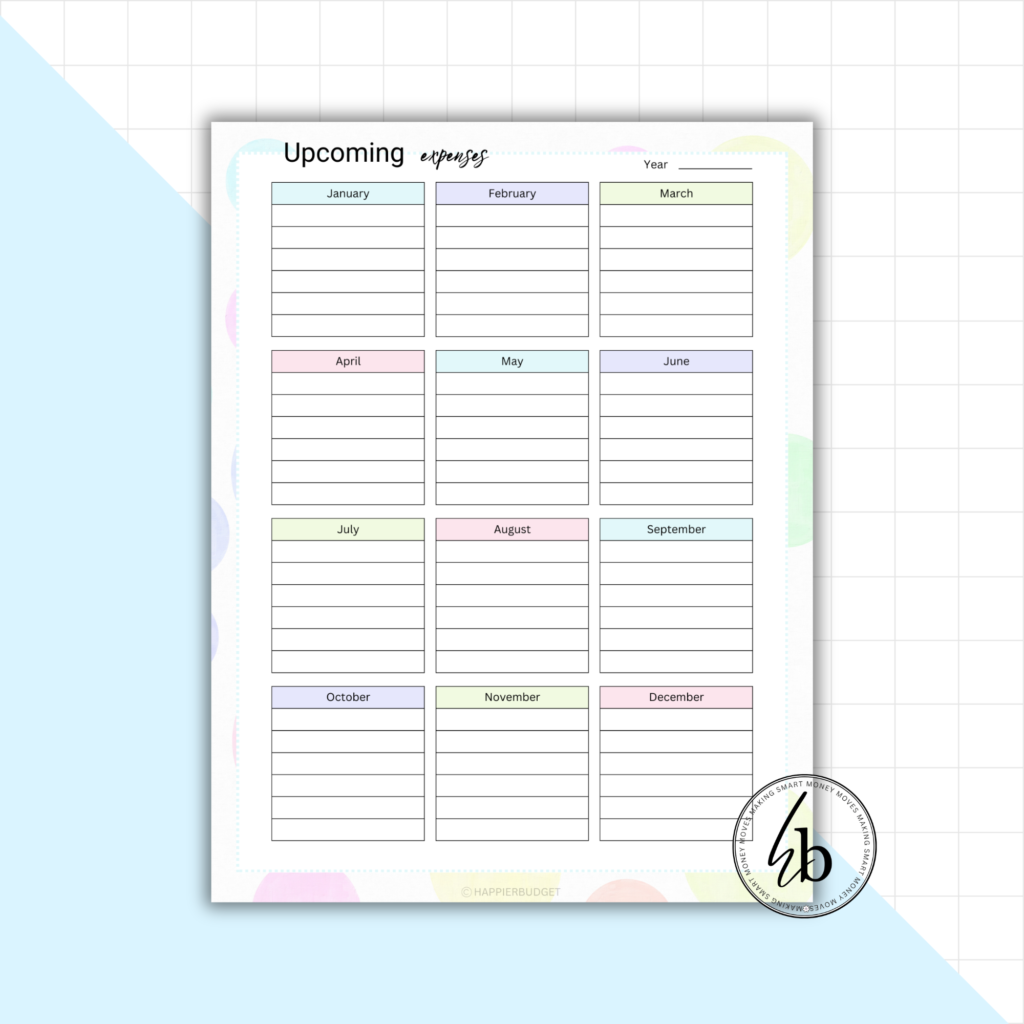

Upcoming Expenses

Planning ahead is key to avoiding financial surprises. This template helps you prepare for irregular expenses such as car repairs, holiday shopping, or medical bills. By listing these in advance, you can start setting aside money little by little instead of scrambling at the last minute.

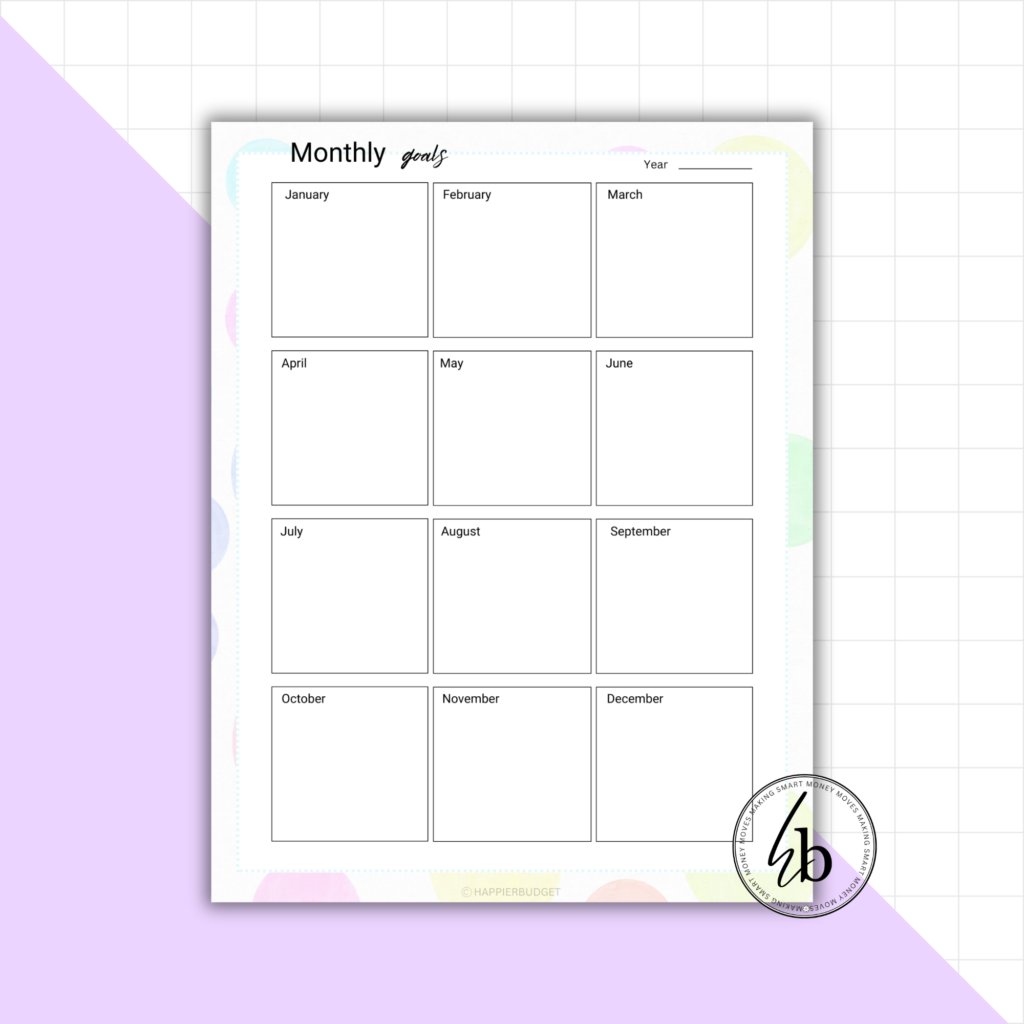

Monthly Goals

Having clear financial goals each month keeps you focused and accountable. Use this section to write down what you want to achieve—whether it’s saving a specific amount, cutting back on dining out, or making an extra debt payment—and track your success.

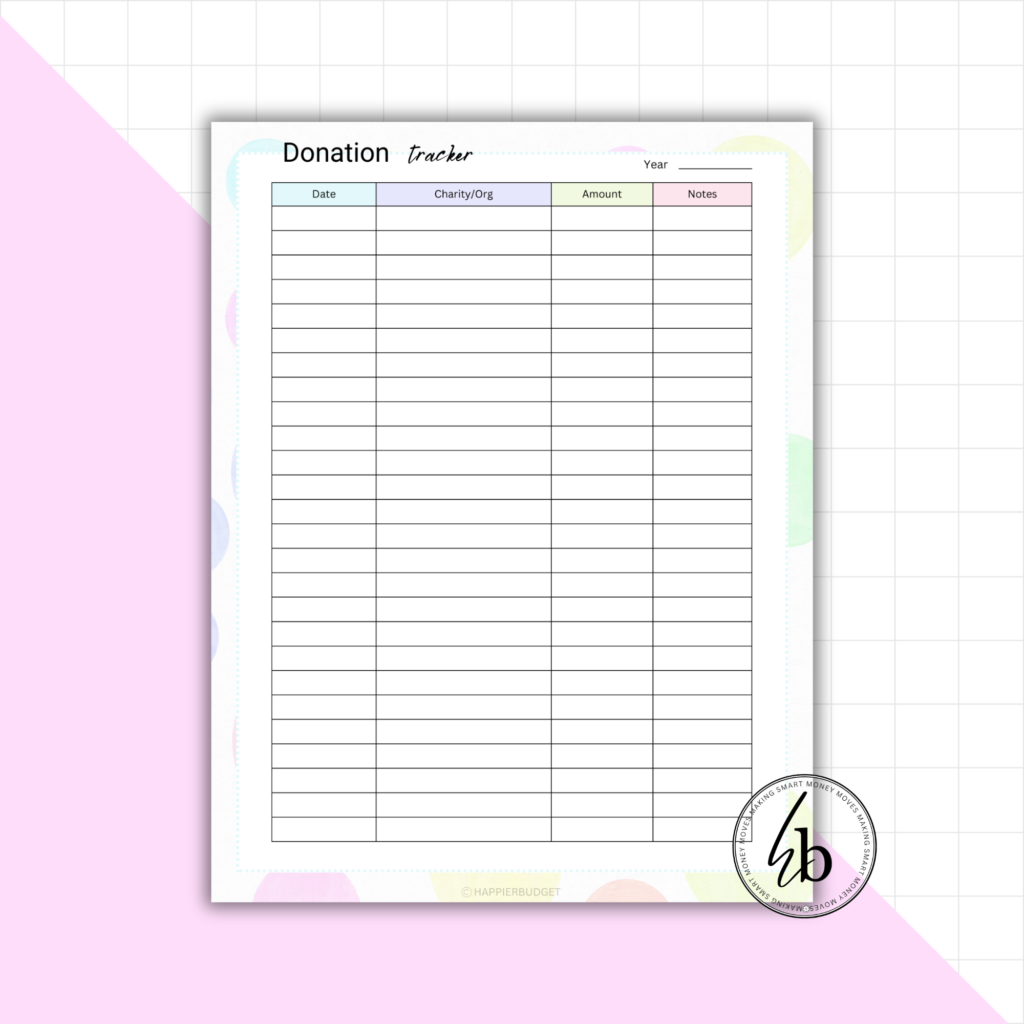

Donation Tracker

If giving back is important to you, this tracker helps you keep track of your charitable donations throughout the year. It also makes tax time easier since you’ll have a clear record of your contributions.

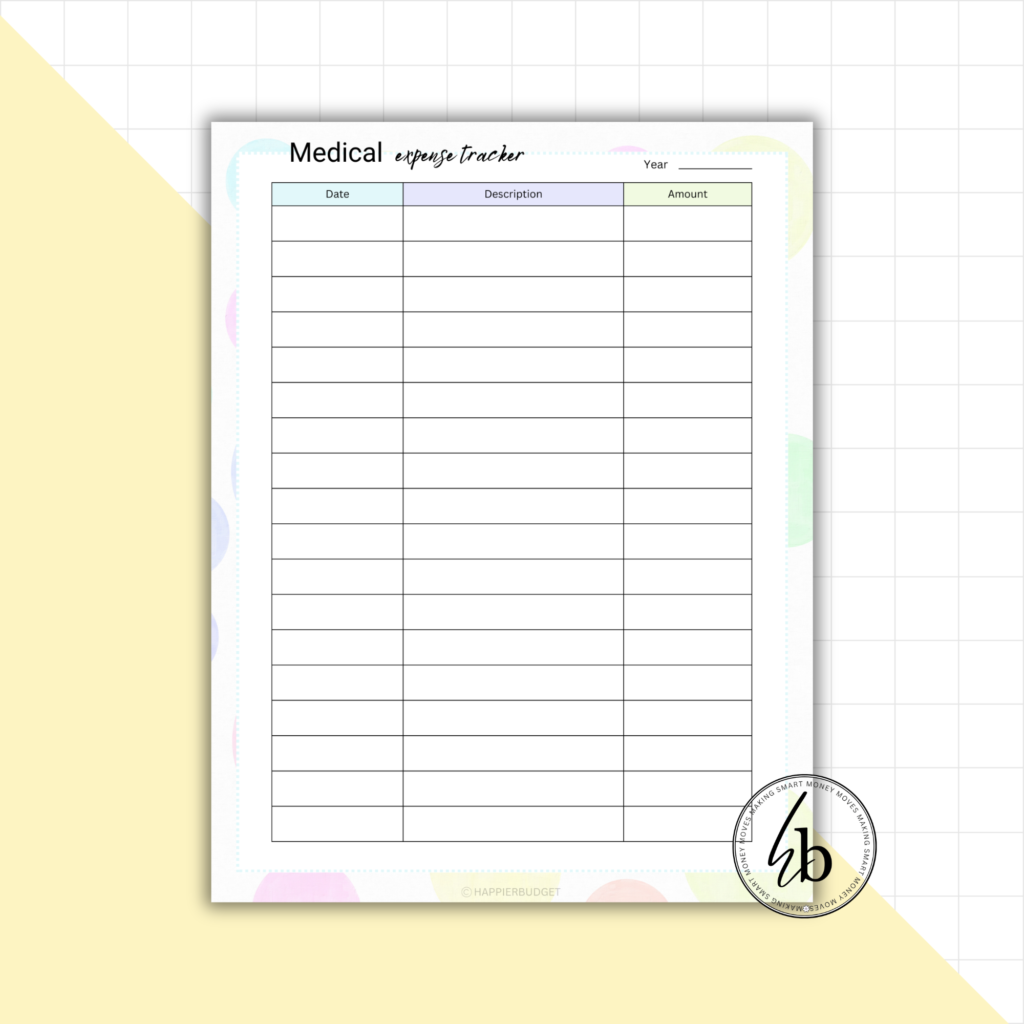

Medical Expense Tracker

Keeping medical costs in check is crucial, especially if you have ongoing healthcare needs. This template allows you to record doctor visits, medications, and out-of-pocket expenses so you can track your healthcare spending and plan accordingly.

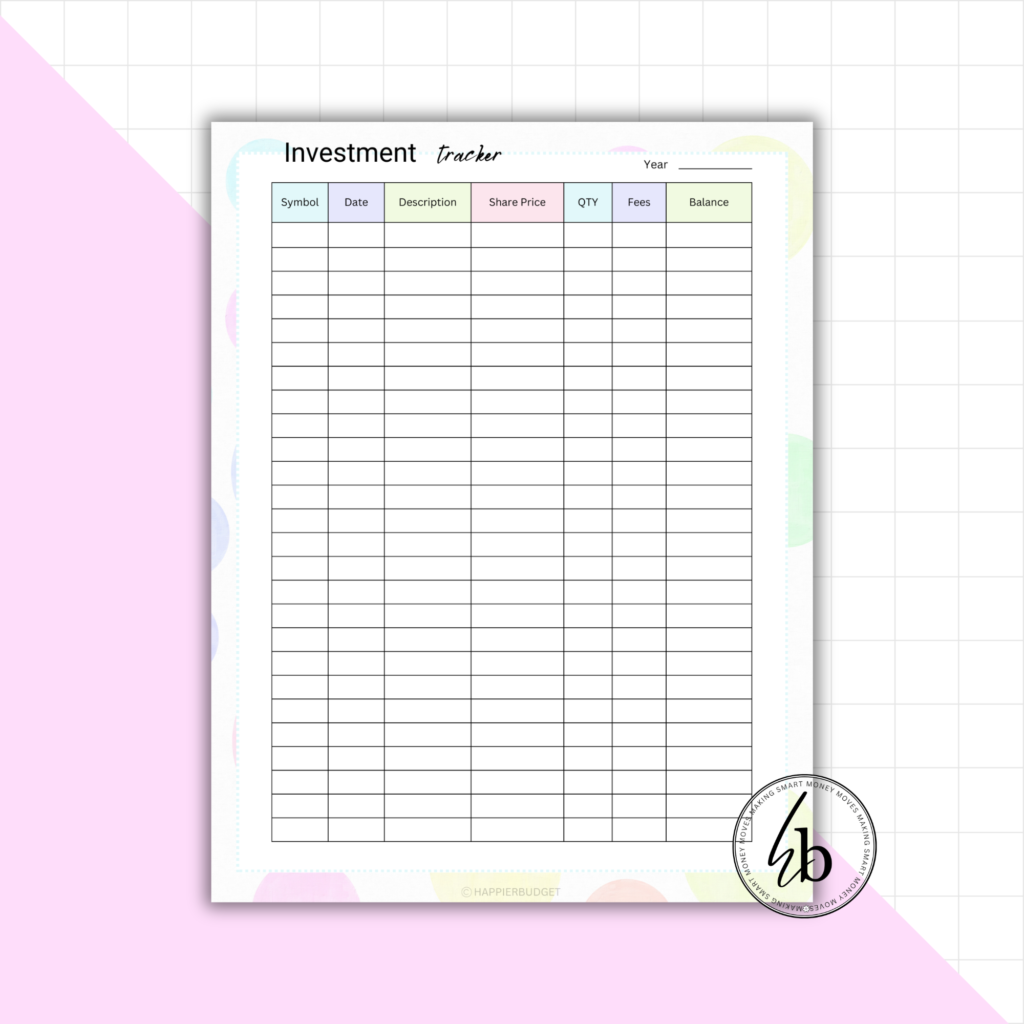

Investment Tracker

If you have stocks, bonds, or other investments, this template helps you monitor their growth. Keeping track of investment performance ensures you stay informed and can make adjustments to your portfolio when needed.

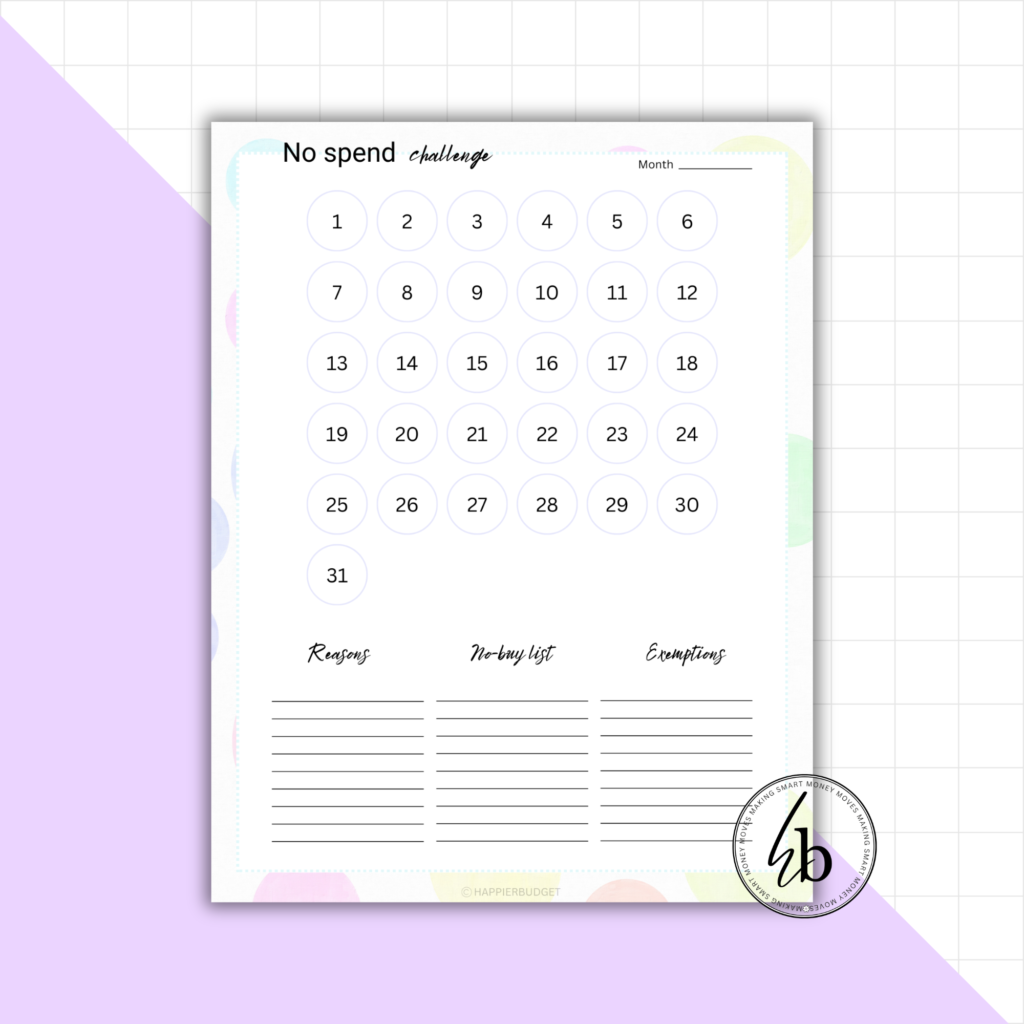

No Spend Challenge

Want to reset your spending habits? This challenge encourages you to track no-spend days, helping you break impulse spending cycles and build better financial discipline. The goal is to go as many days as possible without unnecessary purchases. And if you’re serious about mastering this challenge, check out my No Spend Challenge Workbook! It’s packed with strategies, reflection prompts, and additional tools to help you succeed and make saving money a sustainable habit.

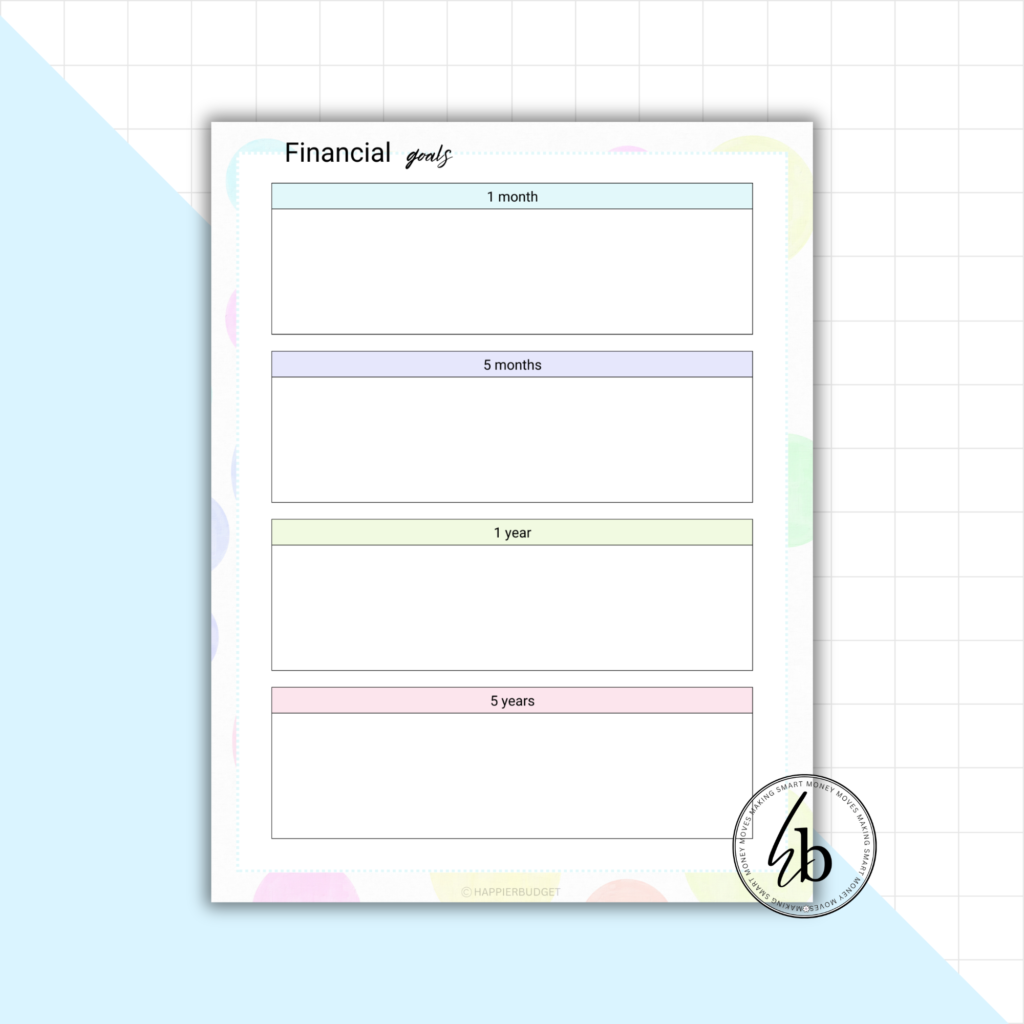

Financial Goals

Long-term financial success starts with clear goals. This template helps you define your big-picture financial dreams, whether it’s homeownership, early retirement, or starting a business, and break them down into actionable steps.

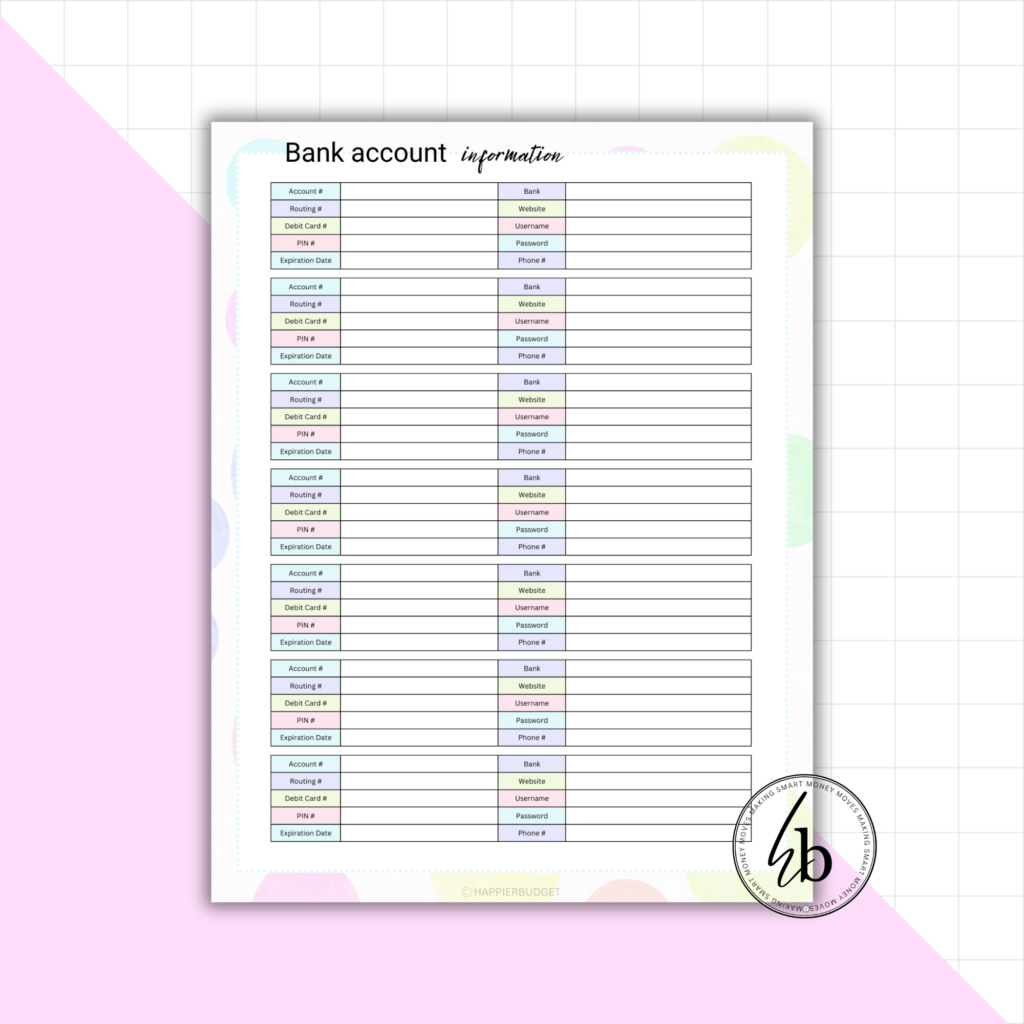

Bank Account Information

Keep all your banking details organized in one place. This section allows you to list account numbers, financial institutions, and other important details, ensuring that all critical financial information is easily accessible when needed.

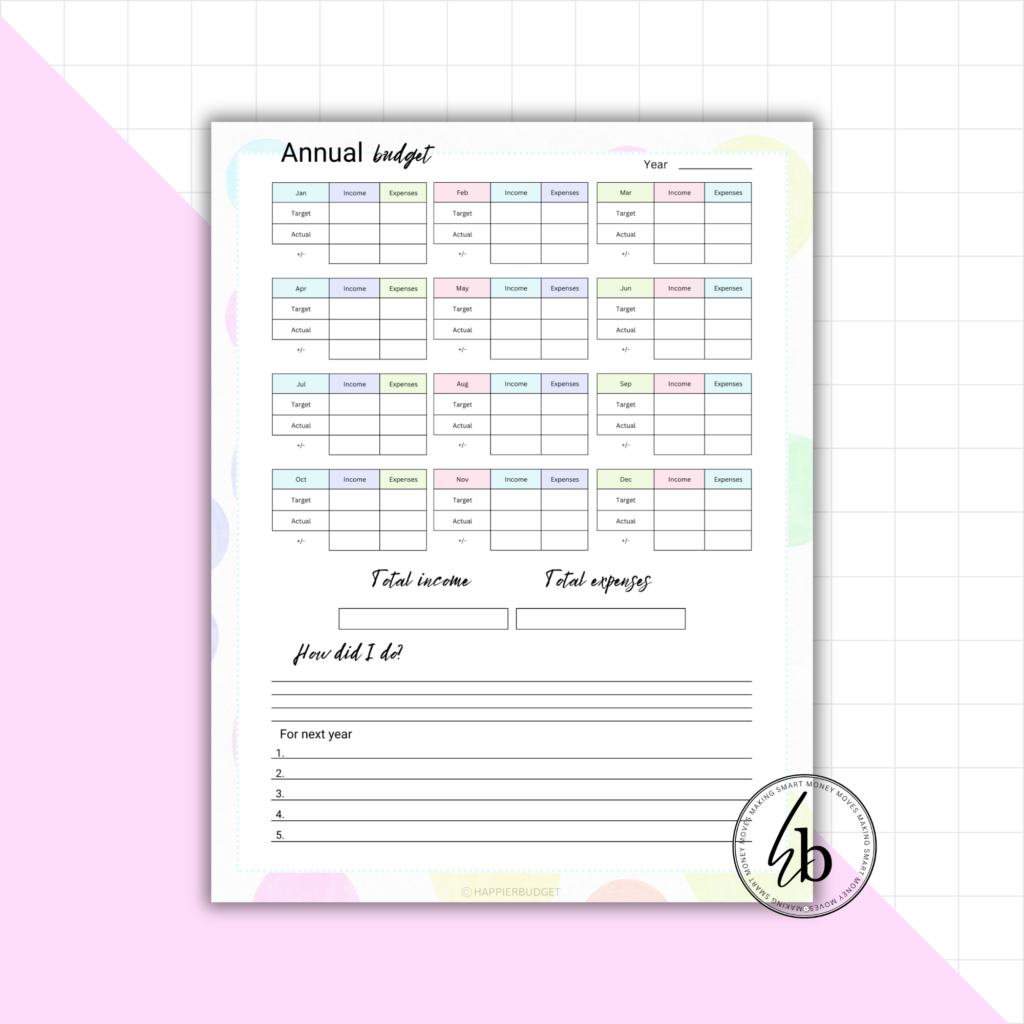

Annual Budget

A big-picture view of your finances is essential for long-term planning. This template allows you to project your income and expenses for the entire year, helping you prepare for major financial events and ensure steady progress toward your goals.

Who is This Planner For?

This Mini Budget Planner is perfect for: Anyone who wants a simple, no-fluff way to manage their money. Stay-at-home moms who need to stretch every dollar. Beginners who feel lost when it comes to budgeting. Anyone looking to save more, spend smarter, and pay off debt.

Why Is It Free?

Because I know what it’s like to feel stuck financially. When I started taking budgeting seriously in 2018, my husband and I saved $16,000 for our first apartment while living with family. Then we saved $7,000 to buy land, and later, $18,000 in a year on one income!

I know firsthand that having the right tools and a clear plan makes all the difference. And I want to help you start making those same kinds of financial wins—without spending a dime upfront. I believe everyone deserves the chance to take control of their finances without having to spend extra money just to get started. This Mini Budget Planner is my way of helping you gain clarity on your budget and build strong financial habits—completely free of charge.

But if you’re looking for an even more detailed, comprehensive budgeting system, be sure to check out my digital budget planners! They offer additional tools, deeper financial tracking, and more advanced strategies to help you master your finances with confidence, like cash savings challenges!

Ready to Take Control of Your Money?

Sign up for my free newsletter and get instant access to the Mini Budget Planner. You’ll also get budgeting tips, savings challenges, and frugal living hacks sent straight to your inbox.

Download your free Mini Budget Planner here!

No more guessing. No more stress. Just a simple system that helps you finally get in control of your money.

Let’s do this!