Table of Contents

Okay, so here’s the thing: I’m a to-do list girl through and through.

Give me a checklist and a highlighter and I’m in my zone.

And when it comes to budgeting and saving money? Oh, I don’t play.

We’ve paid off credit card debt, saved thousands, and built big goals from scratch—because I’m serious about my money.

But a vision board? That always felt a little… extra.

Until one day, I stumbled across a blog post that was talking about financial vision boards—and it stopped me in my tracks.

I’m not gonna lie, it got me thinking: “Wait… why don’t I have my money goals in front of my face like this?”

So I gave it a try.

Not with scissors and glue, but with Canva—I designed my board, saved it as my laptop screen saver, and instantly felt more connected to the vision I’ve been hustling toward.

Now? I’m obsessed.

And I think you might be too.

Let’s talk about how to create a financial vision board that actually works—one that keeps your goals front and center and your energy locked in.

My first Financial Vision Board

When I created my first board, I focused on 3 things:

- Saving for our land in the Dominican Republic

- Becoming debt-free (especially credit card debt—I hate it with a passion)

- Building a $5,000 emergency fund

I added photos of palm trees, kids playing, stacks of money, and affirmations like “Stay determined.”

And guess what? We’ve already knocked out two of those goals.

And yes—I updated my board the second we hit them. Because progress deserves to be celebrated.

What’s a Financial Vision Board, Anyway?

A financial vision board is basically a visual reminder of your money goals.

Think of it like a dream board—but make it personal finance.

Instead of just saying, “I want to save more” or “I want to be debt free,” you create a board that shows it. Pictures, quotes, numbers—whatever sparks something in you.

It’s a way to make your goals feel real, tangible, and motivating.

Why It Actually Works

Let’s get science-y for a sec.

Visualization helps your brain focus.

It keeps your goals front and center—literally—and nudges your daily decisions in the right direction without you even realizing it.

Like, if you have a photo of your dream house on your board, you’re way less likely to blow $60 on a random Target run. Because now? You’re connected to something bigger.

How to Create Your Financial Vision Board

This doesn’t have to be fancy or perfect. Just real and meaningful.

Step 1: Gather Your Supplies

IIf you’re going physical:

- Poster board or notebook

- Magazines, printouts, photos

- Scissors, glue, tape, stickers

- Markers, washi tape, glitter (if that’s your vibe)

If you’re more digital:

- Canva (free and user-friendly)

- Pinterest board

- Google Slides or your fave notes app

- Goodnotes or digital journal

Pick whatever feels easiest to keep coming back to.

Step 2: Define Your Financial Goals

Be specific—don’t just say “save money.”

Break your goals down into:

- Short-Term: Save $1,000, pay off one credit card, cash-flow Christmas

- Mid-Term: Save $5,000 for a car, pay down half your loans

- Long-Term: Buy land, build wealth, retire your man (lol but maybe)

Write them down with deadlines. Claim them like they’re already yours.

Step 3: Find Visual Inspiration

This is the fun part. Look for images that spark something in you.

- A photo of your dream home

- A bank app screenshot with a $0 debt balance

- A visual of peace and freedom

- Photos of your kids, your future, your why

Add quotes or affirmations too:

- “Debt freedom is coming.”

- “Every dollar has a job—and I’m the boss.”

- “Money flows to me with ease and purpose.”

This isn’t about aesthetics. It’s about connection.

Step 4: Organize Your Board

Organize your board however you want:

- By goal type (savings, debt, lifestyle)

- By timeline (short-term → long-term)

- Or just vibes—mood board style

There’s no wrong way. Just make it make sense to you.

Step 5: Add Affirmations and Motivational Quotes

Your board isn’t meant to be hidden. Put it where you’ll see it every day—your desk, closet door, fridge, lock screen, wherever.

If you made it digitally, set it as your wallpaper. Open that instead of Instagram in the morning. Remind your brain what you’re working toward.

Step 6: Display and Use Your Vision Board

TThis isn’t a “make it once and forget it” situation.

Check in with your board regularly. Add new goals, take off the ones you’ve crushed (and celebrate!), and use it to recenter when things feel off.

Especially when you’re tempted to overspend? Look at your board first. Your future self will thank you.

What If You’re More of a Digital Person?

No worries. You can create a digital version in 30 minutes or less.

Here’s a quick way to do it:

- Open Canva and start a blank board

- Upload pics or screenshots of your goals

- Add text with your affirmations

- Download as wallpaper or use in Goodnotes

Done. Functional and cute.

Why You Should Give It a Try

Creating a financial vision board is about way more than cutting and pasting.

It’s about giving your goals space in your life.

It’s about staying connected to your why—even when things get hard.

And honestly? It’s a low-effort way to keep your goals from getting buried under laundry, bills, and the daily chaos of mom life.

So yes—vision boards work. Especially when they’re rooted in something real.

Your Turn: Start Building Your Financial Vision Board

You are allowed to dream bigger.

You are allowed to want more for your family.

You are allowed to build a future that doesn’t include stress, debt, or sacrifice at every turn.

So go build your financial vision board: paper, digital, glitter, whatever.

Make it loud.

Make it clear.

Make it something you can’t ignore.

And if you’re ready to turn that vision into real progress?

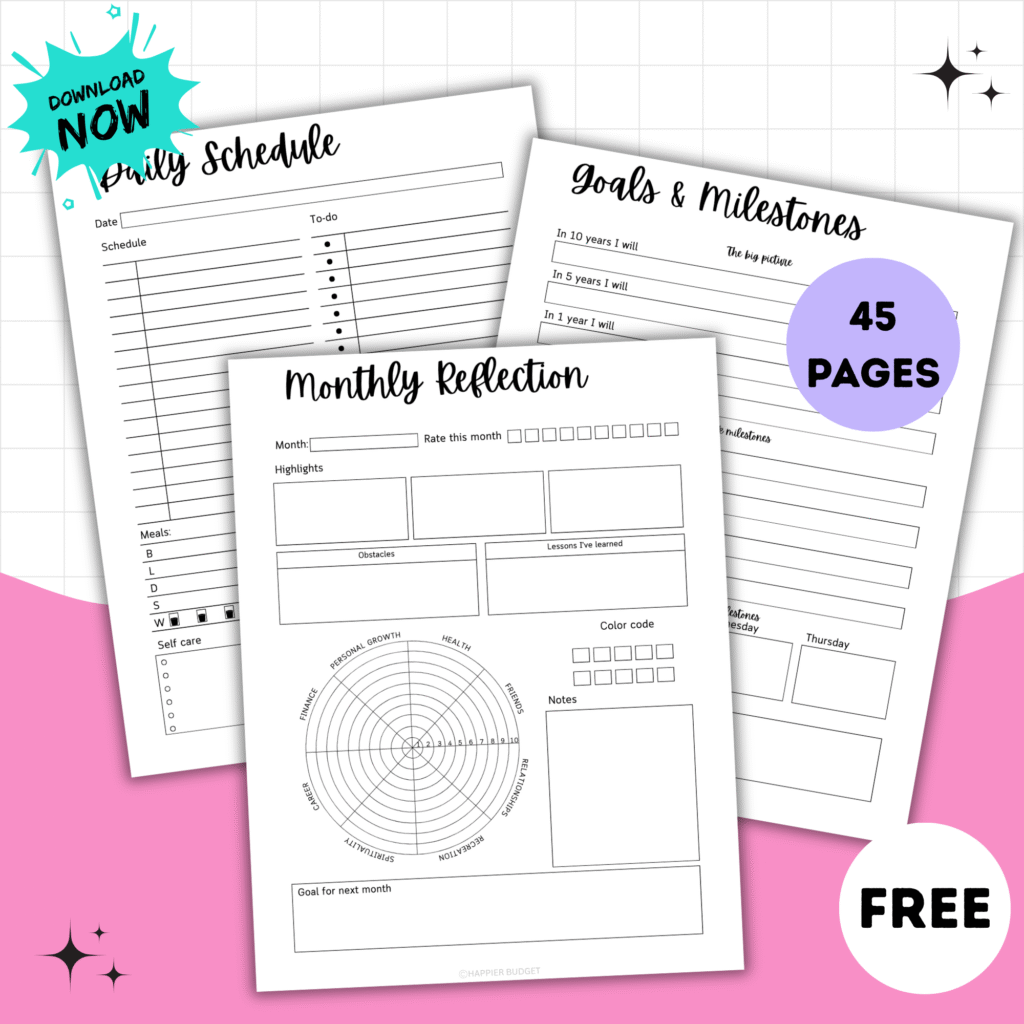

Check out my free Financial Goal Planner printable down below.

It is built to help you stay focused, stay consistent with your financial vision.