Table of Contents

First things first: let’s figure out why money keeps you up at night giving you financial anxiety. For me? It’s the fear of never saving enough. I want to live a life where I don’t have to stress about every dollar, and I want to leave a legacy for my kids. Sound familiar?

Take a moment to reflect on your own financial anxiety triggers. Is it debt? Living paycheck to paycheck? The pressure to keep up with everyone on Instagram? Once you know what’s setting off your stress, you can start dismantling it one piece at a time.

Get Real About Your Finances

This is the part that might make you cringe a little, but hear me out: you cannot fix what you won’t face. Clarity = power.

- Track your spending – Use an app like EveryDollar or just old-school pen and paper. For one month, track every dollar. You might realize you’re spending more on takeout or subscriptions than you thought.

- List your income and debts – All of it. Lay it out so you know exactly what you’re working with. It might feel scary, but it’s actually empowering AF.

- Set realistic goals – Maybe it’s saving $100 this month. Maybe it’s getting one credit card to zero. Start small and build momentum.

Build a Budget That Doesn’t Suck

I know, I know—budgets sound about as fun as a root canal. But hear me out: a budget is just a plan for your money, and it doesn’t have to be restrictive.

- Try the 50/30/20 Rule: Spend 50% of your income on needs (rent, groceries, bills), 30% on wants (Netflix, sushi nights), and 20% on savings or debt repayment.

- Prioritize what matters: If leaving money for your kids is important to you, make that a line item in your budget. Even $50 a month can add up over time.

- Be flexible: Life happens. If you overspend one month, don’t beat yourself up. Adjust and don’t quit.

Start an Emergency Fund (Yes, Really)

One of the biggest sources of financial anxiety is the “what ifs.” What if my car breaks down? What if I lose my job? An emergency fund is your safety net for those moments.

- Start small: You don’t need to save $10,000 overnight. Aim for $500, then $1,000, and keep going from there.

- Automate it so it grows quietly in the background.

- Celebrate milestones: Hit $1,000? Treat yourself to something small (but not too expensive—we’re still budgeting here).

It’s peace of mind in savings account form.

Tackle Debt Like a Boss

Debt equals stress. But you can get through it.

- Pick a strategy: Debt snowball (smallest first) or avalanche (highest interest first).

- Negotiate rates: Call your lender. You might get a lower interest rate just by asking.

- Stop adding to it: Freeze the credit cards—literally, if needed.

Learn About Money (Without Falling Asleep)

Knowledge is power, and when it comes to money, a little education can go a long way.

- Check out books like The Simple Path to Wealth by JL Collins or I Will Teach You to Be Rich by Ramit Sethi.

- Listen to Podcasts: The Financial Diet and ChooseFI are great for millennials trying to figure it all out.

- Talk to a financial advisor if it’s within reach.

Practice Mindful Spending

Here’s a radical idea: what if you could spend money without feeling guilty? Mindful spending is all about aligning your purchases with your values.

- Ask yourself: Does this bring me joy or move me closer to my goals? If not, maybe skip it.

- Pause before buying: Give yourself 24 hours before making a big purchase. You’ll be surprised how often the urge passes.

- Focus on experiences: Instead of buying stuff, invest in experiences that create memories (and don’t clutter your house).

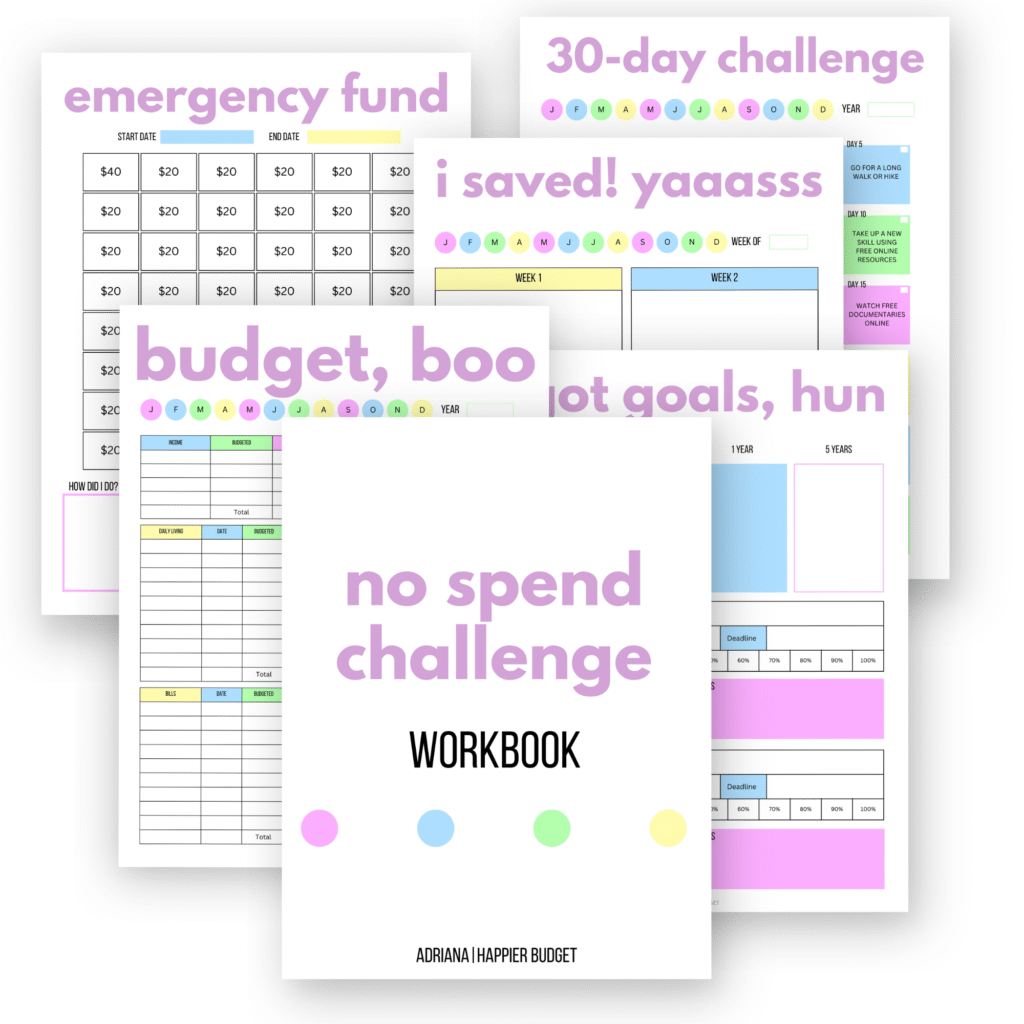

Or start a no spend challenge using my No Spend Workbook to help ease your anxiety while you reset your habits.

Shift Your Money Mindset

Comparison culture is exhausting. Don’t let it run your wallet.

- Unfollow accounts that trigger FOMO

- Celebrate YOUR wins: Paid off a bill? That’s huge.

- Practice gratitude for what you already have

Don’t Go It Alone

You’re not the only one feeling this way.

- Talk about it: Open up to a friend or partner. Chances are, they’ve been there too.

- Join a Community: Online forums like Reddit’s r/personalfinance or Facebook groups can be a great source of support and advice.

- Consider therapy: If the anxiety is deep, talk to a therapist

Final thoughts

Financial anxiety isn’t something you magically fix overnight. But with small, consistent steps, you can take back control. You deserve to live a life where you’re not panicked every time the rent is due or a surprise bill hits your inbox.

Make a plan. Take a breath. Start small. And if you’re ready to organize your finances and feel more in control, grab one of my digital budget planners or challenge yourself to a No Spend Month with my workbook.

You’re not behind. You’re getting started.

And I’m rooting for you every step of the way.

No Spend Challenge Workbook | 41 Pages

Get my No Spend Challenge Workbook today!

Ready to take control of your finances and finally start saving for the things that actually matter? The No Sp…