Table of Contents

Let me be real with you real quick—I absolutely hate being in debt. Owing money, even to family, makes my skin crawl. That’s why I don’t mess with credit cards, store cards, or any other kind of open credit line.

But if you’re in a spot where you’re juggling multiple debts, I want you to know this: you can get out. It might feel like a hot mess right now, but there are smart, doable ways to get through it without losing your mind (or your entire paycheck).

Step 1: Get Clear on What You Owe

Let’s stop guessing and get those numbers in front of you. Make a list of every debt you have:

- Total amount owed

- Interest rate

- Minimum monthly payment

- Due date

Knowing exactly what you’re working with will help you pick the best strategy for paying it off.

Step 2: Pick a Payoff Method That Works for You

There are two tried-and-true strategies: the Debt Avalanche and the Debt Snowball.

Debt Avalanche

- What it does: Pay off the highest interest debt first.

- Why it works: You save more money in the long run.

- Heads up: It might take a while before you feel any progress.

Debt Snowball

- What it does: Pay off your smallest debt first, then move on to the next.

- Why it works: Quick wins keep you motivated.

- Heads up: You may end up paying more interest overall.

Real-Life Example: $15,763 in Debt

Let’s say you owe:

- $5,000 at 18% interest (Credit Card)

- $3,763 at 10% interest (Personal Loan)

- $7,000 at 5% interest (Car Loan)

Here’s how each method plays out:

- Snowball Method: You pay off the $3,763 loan first. It feels good but costs more in interest overall.

- Avalanche Method: You tackle the $5,000 credit card first. It takes longer to see results but saves you money in the long run.

Pick the method that fits your mindset and lifestyle. It’s better to stick with it than to aim for the “perfect” one and quit halfway through.

Example Breakdown: $15,763 in Debt

Let’s say you have the following debts:

- $5,000 at 18% interest (Credit Card)

- $3,763 at 10% interest (Personal Loan)

- $7,000 at 5% interest (Car Loan)

Total interest paid:

- Snowball method (smallest balance first): Higher total interest

- Avalanche method (highest interest first): Lower total interest

Months to payoff:

- Snowball Method: Slightly longer due to prioritizing smaller debts.

- Avalanche Method: Faster because high-interest debts are tackled first.

Step 3: Budget Like a Boss

Now that you’ve got your strategy, it’s time to back it up with a solid budget.

- Review your income and expenses.

- Cut back on anything unnecessary (yes, even your fifth streaming service).

- Funnel every extra dollar toward your debt.

Step 4: Protect Yourself from More Debt

his is huge. You can’t dig yourself out if you’re still digging.

- Avoid opening new credit lines.

- Build a mini emergency fund (even $500 helps).

- Automate payments to avoid late fees and missed due dates.

Step 5: Celebrate Progress!

Debt payoff is no joke. Give yourself credit (pun intended) for every step.

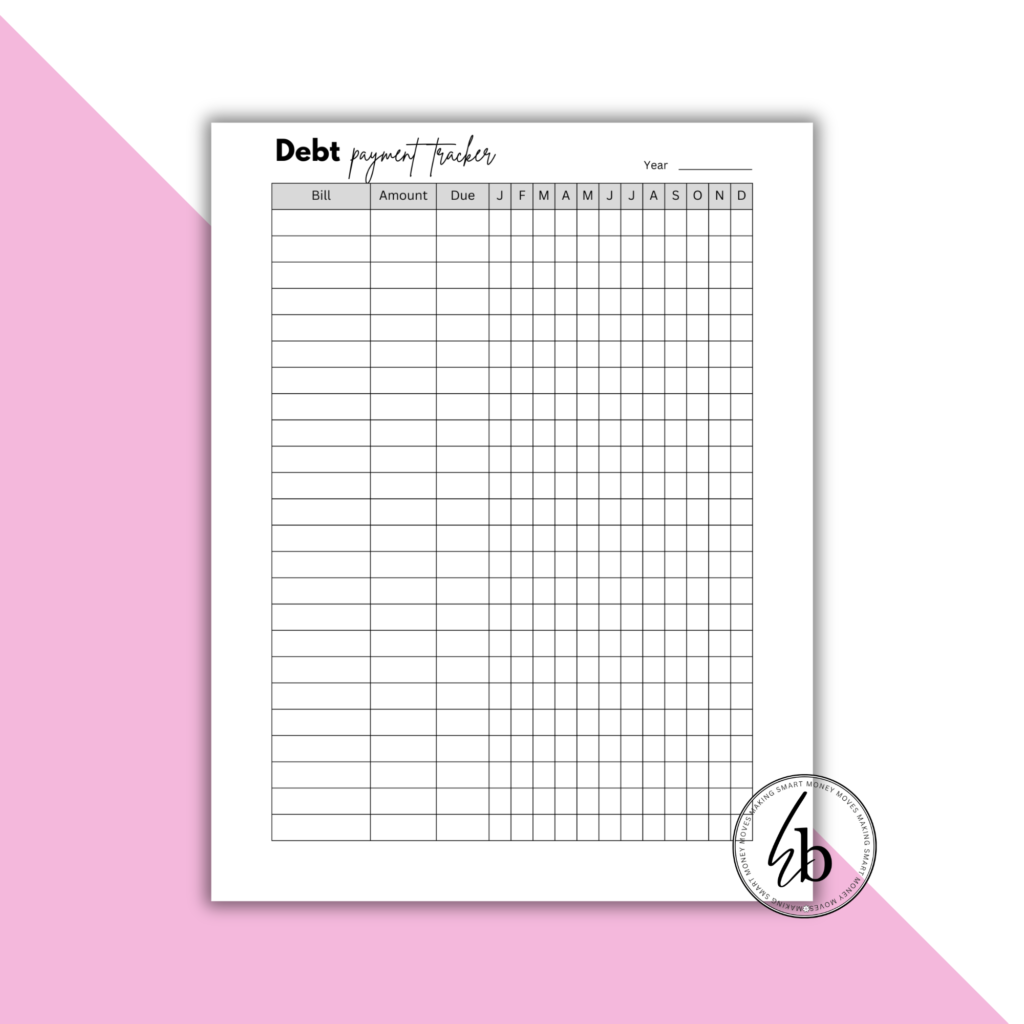

- Use a debt tracker to stay motivated.

- Celebrate mini milestones (without blowing your budget).

- Keep your eyes on the prize: financial freedom.

Ready to Crush Your Debt?

I got you. Grab your FREE debt repayment tracker by clicking the picture below and get ready to start crossing those debts off your list.

You’ve got this. And you’re not doing it alone.