Table of Contents

Let me paint you a picture.

It’s payday. You’re feeling that momentary high—finally, money in the account! But before you can even breathe, it’s gone. Bills, groceries, Amazon “treat yourself” moments, last-minute takeout… the usual suspects. And just like that, you’re back to square one, wondering where it all went.

Girl, I’ve been there.

As a stay-at-home mom with three kids under eight, we were living off one income. My husband worked hard, but no matter how much he brought in, it felt like we were bleeding money. That constant stress? That sinking feeling of being broke, again? I was over it.

So I made a decision. No more surviving. It was time to get intentional with our money.

One year later, we saved $18,000—yes, on a single income. No lottery wins. No side hustles. Just good old-fashioned budgeting, mindset shifts, and some strategic lifestyle changes. Here’s exactly how we did it (and how you can too).

The Light Bulb Moment That Changed Everything

It wasn’t just about saving money. We had a goal that lit a fire under us: buy land in the Dominican Republic and start building our forever home.

We knew we couldn’t get there by continuing to spend like we had money to waste. We were ready to ditch the paycheck-to-paycheck life and finally get ahead. That goal gave us tunnel vision.

So what’s your light bulb moment? A dream home? Paying off debt? Traveling more? Get crystal clear on that, because it’ll be your fuel when motivation dips.

Our Real-Life Budget Categories

Forget the budgeting methods that feel like algebra homework. I kept it real and focused on what actually matters to our family.

Here’s what we included:

- Rent

- Food (groceries + occasional takeout)

- Park money (snacks, icies, you know the drill)

- Transportation fare (for hubby)

- Savings (this always came first!)

- Family fun (yes, we still had fun)

- Hubby’s spending fund

- Light bill

- Cellphones

- Kid’s clothing

- Beauty/personal care

- Amazon Prime

- Amazon Photos

- Diapers & wipes

- HSLDA membership (for homeschooling)

- NameHero hosting (yearly)

- Domain renewals (yearly)

Budgeting isn’t about punishment. It’s about being the boss of your money. We didn’t stop living—we just started spending with purpose..

Food: Where Most of Our Money Was Sneaking Off To

This category was a beast. Between the homeschool hustle, toddler chaos, and zero energy left to cook, takeout became our BFF. But those quick bites? They were quietly stealing hundreds a month.

Now, it’s not that I hate cooking, but after a day of homeschooling, cleaning, and chasing toddlers around the hour or the park, the last thing I want to do is whip up a meal. And my sweet husband, always wanting to make my life easier, would often say, “Just order out! We got money! Tomorrow is never promised”

Breaking Up with Takeout:

I realized that while those takeout meals were convenient, they weren’t doing us any favors financially. So, I decided to channel my inner chef and get back in the kitchen more often.

Our Food Glow-Up:

- Meal planning: Every Sunday, I planned our meals and kept it simple but tasty.

- Leftovers love: I learned to stretch meals and actually look forward to leftovers.

- No list, no shopping: I stopped winging it at the store and stuck to my grocery list.

- Freezer magic: Made double batches and froze them for busy days.

We didn’t eliminate eating out completely. We just stopped using food as a crutch. That one shift alone saved us hundreds each month.

Thrifting Whenever Possible

Look, I love cute clothes for my babies as much as the next mama. But those little humans grow like weeds. Why drop $40 on an outfit they’ll wear for three months?

I tapped back into my pre-kid thrifting days and never looked back:

- Hit up Le Point Value, Salvation Army, and even Dollar Tree.

- Bought gently-used toys, books, and even furniture.

- For $150? I could walk out with bags of clothes that lasted for months.

Also, It became a fun bonding activity. The kids loved treasure hunting. And I loved keeping our budget intact.

Potty Training Payoff

Real talk: Diapers are expensive AF. We were spending around $27/month on them. So when our little one was ready, we committed to potty training boot camp.

Was it messy? Yup. Did it involve way too much laundry? Also yes.

But a month later? Diaper-free.

We saved over $300 a year, helped the planet, and gained a whole new level of parenting pride.

It might not be the most glamorous savings tip, but trust me, it’s a game-changer for both your wallet and your sanity. And hey, who doesn’t love celebrating those little victories, right?

Cutting Our Phone Bill In Half (And Then Some)

We were with T-Mobile and paying way too much for unlimited everything. But we weren’t even using it all.

Breaking Up with big phone companies:

I did some digging and discovered Mint Mobile, a budget-friendly carrier that actually makes sense. I was hesitant at first, but the savings were too good to ignore. So, I took the plunge and switched.

So we switched to Mint Mobile and never looked back:

- Downgraded to 5 gigs (we’re home 90% of the time with Wi-Fi anyway)

- Paid $210 upfront for 6 months

- Saved over $840/year

Same service. Less money. That’s a win.

We Said “Goodbye” to Our Car

Our car was costing us more than it was worth. Between the $386/month in insurance and the never-ending fixes, it had to go.

No car = no insurance + no gas + no repairs = $4632 saved annually.

We made it work with public transportation, walking, and planning ahead. Not always convenient, but it worked.

The Tiny Wins That Added Up Big

ometimes it’s the little tweaks that make the biggest difference:

- Cut the cord: Bye cable. Hello Netflix, Disney+, and $50/month saved.

- Canceled Apple iCloud: Switched to Amazon Photos (free unlimited photo storage with Prime!)

- Used digital and printable savings trackers: Staying on top of progress made saving kinda fun

Every dollar saved had a job—and those jobs added up quick.

The Real Secret Sauce: Mindset

Saving $18,000 wasn’t just about numbers. It was about choosing long-term goals over short-term comfort.

We didn’t stop living. We just:

- Got hyper-aware of where our money was going

- Stayed laser-focused on our why

- Learned to say “not right now” to things that didn’t align with our vision

Final thoughts

If you’re in the thick of the paycheck-to-paycheck grind, let this be your sign. You’re not stuck. You’re just one mindset shift away from major change.

Start small. Keep it real. And celebrate every win.

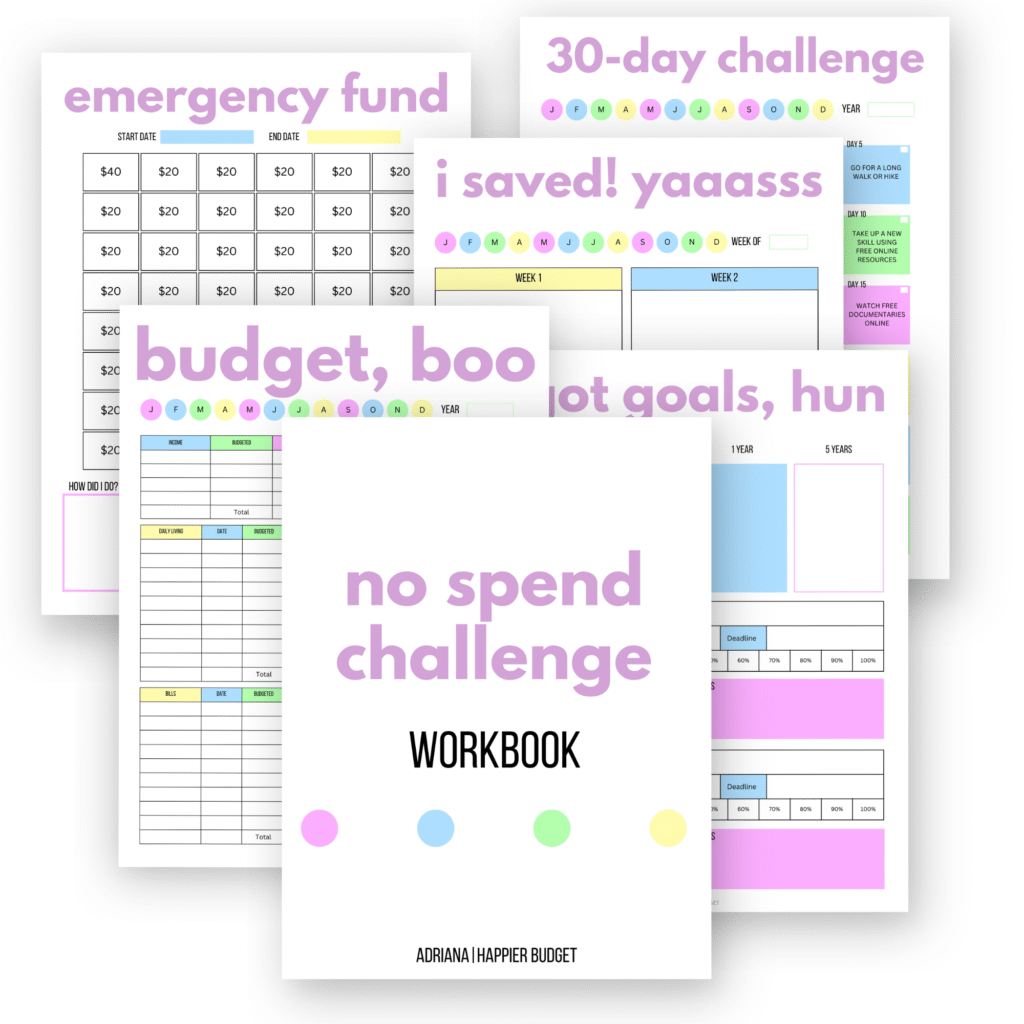

Want a little extra help? Check out my No Spend Challenge Workbook down below—it’ll help you stay focused, save more, and start crushing those money goals like the boss you are.

Listen, if this tired, café-con-leche-fueled mama of three can save $18K in a year, you can too.

No Spend Challenge Workbook | 41 Pages

Get my No Spend Challenge Workbook today!

Ready to take control of your finances and finally start saving for the things that actually matter? The No Sp…

This article is incredibly inspiring and offers practical strategies for saving money on a single income. The emphasis on budgeting, cutting unnecessary expenses, and finding affordable alternatives is particularly helpful. One area where I’ve found significant savings is by switching to more affordable mobile service providers. For instance, Whoop Mobile offers budget-friendly plans without compromising on quality, which can be a smart move for those looking to cut costs without sacrificing essential services