Table of Contents

Ever look at your bank account and think, “Where did all my money even go?” Or daydream about buying a house, taking your kids to Disney without swiping a credit card, or saying bye to the 9-to-5 forever?

Yeah. Me too. And that’s exactly why goal setting is the glow-up your finances need.

If you’re ready to level up your finances, this post is your jumpstart. I’m walking you through how to set goals that actually stick—no complicated spreadsheets, no boring budget lectures. Just real-life strategies that work (even if you’re brand new to this).

Why You Need Financial Goals (No, really)

Ain’t no damn way you’re reaching dream-life status by winging it with your money.

Financial goals = your roadmap. That’s it.

Wanna:

- Build an emergency fund so flat tires don’t ruin your whole week?

- Move to a new city?

- Pay off debt without spiraling?

You need a goal. You need tunnel vision. You need discipline. (This post will show exactly what you need to take your finances serious. It’s a freaking game-changer)

My personal goal?

Financial freedom. Build our dream home. Move to the Dominican Republic with my husband and our 3 babies, and never have to stress about a paycheck again.

That’s what keeps me focused. That’s what helps me say “no” to random Amazon impulse buys and “yes” to the big picture.

Your Goal-Getter Starter Kit (How to level up your finances with goal setting that actually works)

Dream big (then get specific):

- Write down every dream, no matter how wild.

- Want to retire at 40?

- Own land?

- Start your own business?

Cool. Now zoom in.

Instead of “save money,” try: “Save $5,000 for a condo down payment by next December.”

Break it all the way down:

- Big goals feel scary until you break them into monthly or weekly baby steps.

- Trying to save $5,000 in a year? That’s about $417 a month.

- Way more doable when you see it like that, right?

PS: We saved $18,000 in one year on one income—read how we did it here.)

Track Your Progress (and hype yourself up):

- Whether you’re using a budgeting app, a cute printable, or your Notes app at midnight—track your wins.

- Every $50 you save is a step closer. Celebrate that.

Be flexible (life happens):

- Things change. Jobs, income, car repairs, kids needing 10 snacks before 10am…

- Goals aren’t set in stone. Adjust. Pivot. Keep going.

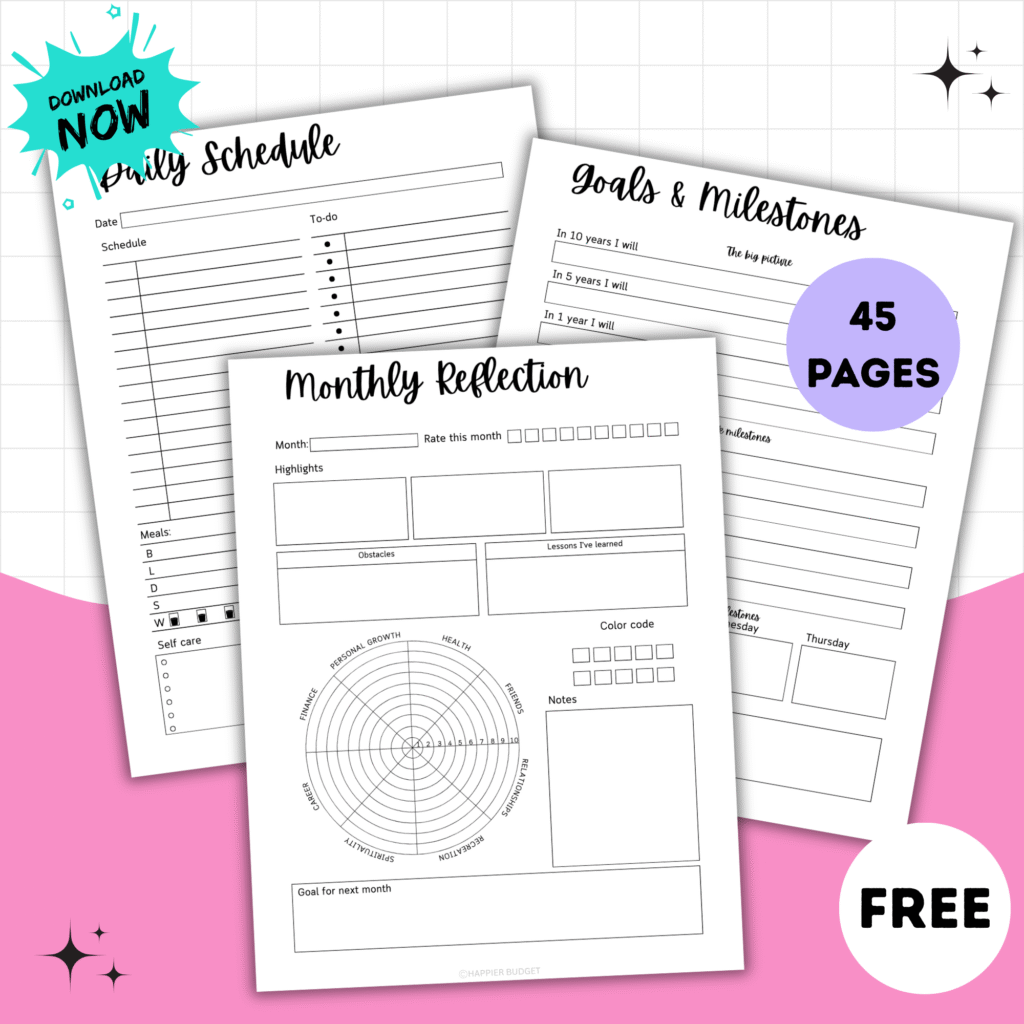

If you want a little extra help getting started, grab our free financial goal setting worksheet by clicking the picture below. It’s a great way to organize your thoughts and create a clear action plan.

Grab Your Free Financial Goal Setting Worksheet

If your brain’s spinning with ideas but you don’t know where to start, this free worksheet is your new bestie.

Use it to map out your goals and finally get your money working for you.

Millennial-Friendly Financial Goal Ideas

Need inspo? Try one of these:

- Pay off student loans without crying monthly

- Build a 3-6 month emergency fund so surprise bills don’t wreck you

- Plan a trip (and actually pay for it in cash)

- Start investing—yes, now

- Set aside money for that course or biz idea you keep putting off

Final thoughts

You don’t need to have it all figured out.

You just need to start.

Leveling up your finances with goal setting isn’t about being perfect, it’s about making progress that aligns with the life you actually want.

One goal at a time. One decision at a time.

Listen, if I can do this while being a stay-at-home-mom to 3 kids and homeschooling, so can you.

You in?