Table of Contents

When I first started budgeting many years ago, the 50/30/20 rule was the method that made the most sense to me. It was simple, easy to follow, and gave me a clear structure to work with. If you’re feeling overwhelmed by the thought of budgeting, I totally get it—but trust me, this rule can be a game-changer.

Budgeting doesn’t have to be complicated or stressful. The 50/30/20 rule is a straightforward way to manage your money without feeling like you’re drowning in spreadsheets or confusing money talk. Let’s break it down together and see how it can work for you.

What is the 50/30/20 Rule?

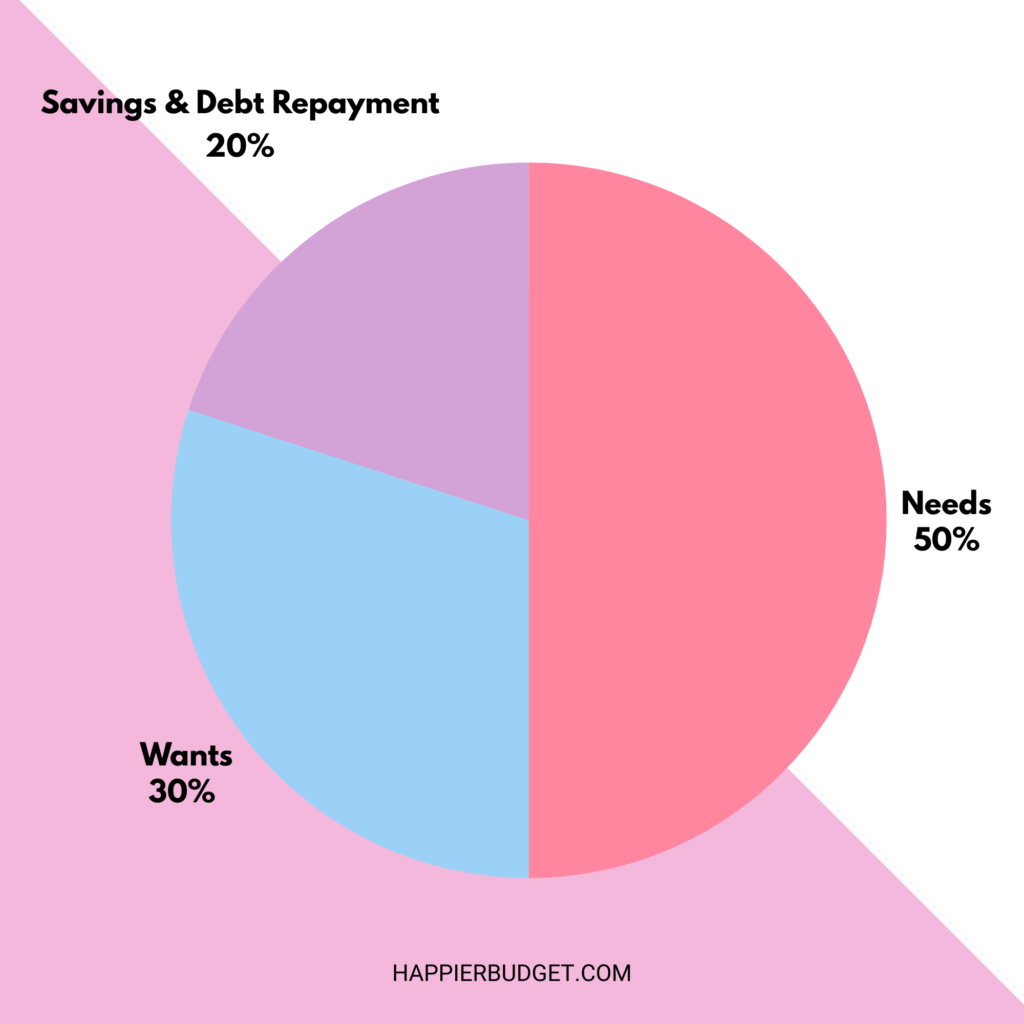

TThe 50/30/20 rule is a simple budgeting framework that helps you divide your after-tax income into three main categories:

- 50% for needs – Think of essentials like rent or mortgage, groceries, utilities, insurance, and transportation. These are things you can’t live without.

- 30% for wants – This is where you get to enjoy life a little! Dining out, entertainment, shopping, and hobbies fall into this category.

- 20% for savings & debt repayment – This portion goes toward your financial goals, whether that’s building an emergency fund, saving for a house, or paying off debt.

Simple, right? That’s what I loved about it when I first started. It gave me a clear picture of where my money should go without feeling like I had to give up everything I enjoyed.

Why the 50/30/20 Rule Works

One of the reasons this method is so effective is because it balances your needs, wants, and future goals. It gives you permission to spend on things you enjoy while still making sure you’re handling your responsibilities and planning for the future.

Think about it—how often do we tell ourselves, “I’ll start saving when I make more money” or “I can’t budget because my income isn’t enough”? The truth is, no matter how much you make, having a plan helps you stay in control.

The 50/30/20 rule takes away the guesswork and decision fatigue that often comes with budgeting. It sets boundaries but still allows for flexibility and enjoyment.

How to Apply the 50/30/20 Rule to Your Budget

Ready to give it a try? Here’s how you can apply the 50/30/20 rule to your finances:

1. Calculate Your After-Tax Income

Start by figuring out how much money you take home each month after taxes. This includes your salary, side hustle income, or any other earnings.

2. Categorize Your Expenses

Take a look at your spending habits and sort them into needs, wants, and savings. Be honest with yourself! Are you spending too much on things that aren’t truly essential?

3. Adjust as Needed

If your “wants” are eating into your “savings,” it might be time to cut back a little. Can you cook at home more often or find free ways to entertain yourself?

It might take a few months to get it right, and that’s okay. Budgeting is a practice, not a perfect science.

Overcoming Common Challenges

I know firsthand that sticking to a budget isn’t always easy. Life happens, unexpected expenses come up, and sometimes it feels like there just isn’t enough money to go around. Here are a few challenges you might face and how to tackle them:

- Struggling with unexpected costs? Build an emergency fund within your savings category to cover those surprises.

- Feeling guilty about spending on wants? Remember, budgeting isn’t about deprivation—it’s about balance.

- Irregular income? Base your budget on your lowest expected income and adjust when extra money comes in.

Give yourself grace as you learn to adjust. The more consistent you are, the easier it becomes.

How the 50/30/20 Rule Can Simplify Budgeting for Moms

If you’re a busy mom trying to juggle a million things (I see you!), the 50/30/20 rule can help simplify your financial life. It’s flexible and easy to maintain, even with a packed schedule.

It also gives you clarity and structure for your family’s finances. Whether you’re saving for your child’s education, that long-overdue family vacation, or starting a small business from home, this method gives you room to breathe while making progress.

Take a moment to think: Are you managing your money in a way that aligns with your family’s long-term goals? If not, the 50/30/20 rule might be your starting point.

Alternatives to the 50/30/20 Rule

While the 50/30/20 rule is a great starting point, it’s not a one-size-fits-all solution. Depending on your situation or goals, these alternatives might serve you better:

- Zero-Based Budgeting – Assign every dollar a job so that nothing goes unaccounted for.

- Cash Envelope System – Use cash for specific spending categories to stay within limits. (Check out my cash envelope labels down below!)

- Custom Percentages – If saving more is your top priority, consider adjusting your percentages to fit your goals. You could try 30/40/30 or 60/20/20 depending on your lifestyle.

The best system is the one you actually stick to. If the 50/30/20 framework feels too tight or too loose, make tweaks until it fits like your favorite pair of jeans.

Is the 50/30/20 Rule Right for You?

The beauty of this method is its simplicity, but it only works if you’re honest about your spending and willing to make adjustments where needed. Ask yourself:

- Are you consistently saving enough for the future?

- Do you feel like your spending reflects your priorities?

- What changes could you make today to bring you closer to financial freedom?

If you’re ready to take budgeting seriously but feel like you’re drowning in too many numbers, the 50/30/20 rule might just be your lifeboat.

Final thoughts

If you’re just starting out or feeling stuck with your finances, the 50/30/20 rule is a fantastic way to gain control and build momentum. It helped me stay on track when I first began my budgeting journey, and I know it can help you too.

Remember, budgeting isn’t about restricting yourself, it’s about giving yourself the freedom to spend intentionally and achieve your dreams. Whether you want to pay off debt, save for a home, or just feel more at peace with your money, having a plan is the first step.

So, are you ready to take control of your finances and simplify your budget with the 50/30/20 rule? Let me know in the comments what your biggest budgeting challenge is!